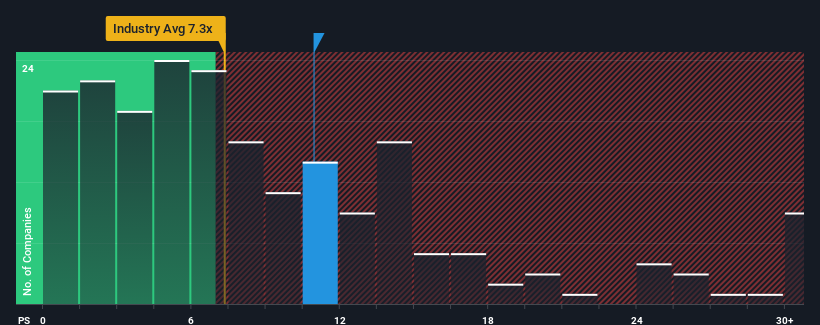

You may think that with a price-to-sales (or "P/S") ratio of 10.9x Shanghai Orient-Chip Technology Co.,LTD. (SHSE:688061) is a stock to potentially avoid, seeing as almost half of all the Semiconductor companies in China have P/S ratios under 7.3x and even P/S lower than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Shanghai Orient-Chip TechnologyLTD

How Has Shanghai Orient-Chip TechnologyLTD Performed Recently?

Shanghai Orient-Chip TechnologyLTD hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shanghai Orient-Chip TechnologyLTD.Is There Enough Revenue Growth Forecasted For Shanghai Orient-Chip TechnologyLTD?

Shanghai Orient-Chip TechnologyLTD's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 44%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 30% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 83% as estimated by the one analyst watching the company. With the industry only predicted to deliver 39%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Shanghai Orient-Chip TechnologyLTD's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Shanghai Orient-Chip TechnologyLTD's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Shanghai Orient-Chip TechnologyLTD shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Shanghai Orient-Chip TechnologyLTD that you should be aware of.

If these risks are making you reconsider your opinion on Shanghai Orient-Chip TechnologyLTD, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.