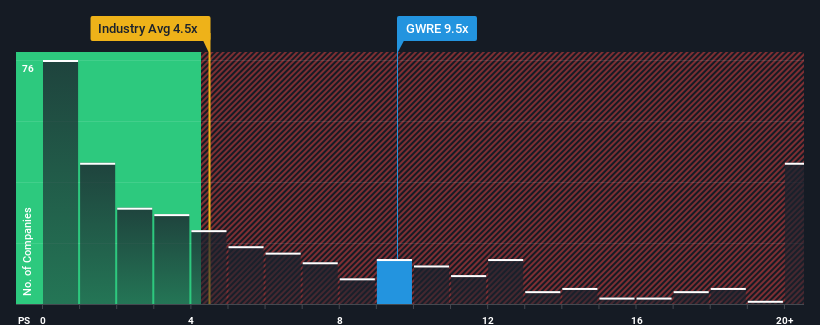

You may think that with a price-to-sales (or "P/S") ratio of 9.5x Guidewire Software, Inc. (NYSE:GWRE) is a stock to avoid completely, seeing as almost half of all the Software companies in the United States have P/S ratios under 4.5x and even P/S lower than 1.8x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Guidewire Software

NYSE:GWRE Price to Sales Ratio vs Industry January 9th 2024

What Does Guidewire Software's P/S Mean For Shareholders?

Guidewire Software could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Guidewire Software could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think Guidewire Software's future stacks up against the industry? In that case, our free report is a great place to start.

Is There Enough Revenue Growth Forecasted For Guidewire Software?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Guidewire Software's to be considered reasonable.

Retrospectively, the last year delivered a decent 9.0% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 22% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 13% per annum during the coming three years according to the analysts following the company. With the industry predicted to deliver 17% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Guidewire Software's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Guidewire Software's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've concluded that Guidewire Software currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Guidewire Software that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.