Results: Richardson Electronics, Ltd. Delivered A Surprise Loss And Now Analysts Have New Forecasts

Results: Richardson Electronics, Ltd. Delivered A Surprise Loss And Now Analysts Have New Forecasts

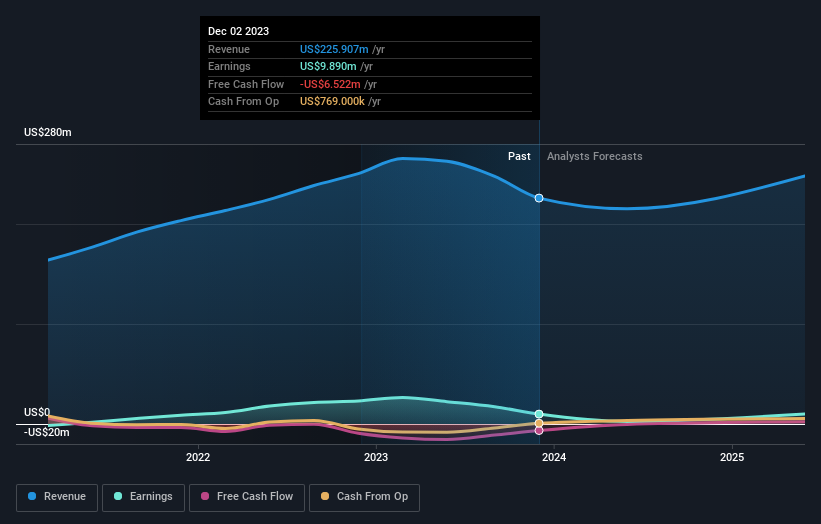

There's been a notable change in appetite for Richardson Electronics, Ltd. (NASDAQ:RELL) shares in the week since its quarterly report, with the stock down 18% to US$10.40. It looks like a pretty bad result, given that revenues fell 15% short of analyst estimates at US$44m, and the company reported a statutory loss of US$0.13 per share instead of the profit that the analyst had been forecasting. Following the result, the analyst has updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. With this in mind, we've gathered the latest statutory forecasts to see what the analyst is expecting for next year.

自發布季度報告以來,理查森電子有限公司(納斯達克股票代碼:RELL)股票的需求在本週發生了顯著變化,該股下跌了18%,至10.40美元。這似乎是一個相當糟糕的結果,因爲收入比分析師預期的4400萬美元低了15%,而且該公司報告的法定虧損爲每股0.13美元,而不是分析師預測的利潤。根據結果,分析師更新了他們的盈利模式,很高興知道他們是否認爲公司的前景發生了巨大變化,或者業務是否照舊。考慮到這一點,我們收集了最新的法定預測,以了解分析師對明年的預期。

Check out our latest analysis for Richardson Electronics

查看我們對理查森電子的最新分析

After the latest results, the consensus from Richardson Electronics' lone analyst is for revenues of US$215.2m in 2024, which would reflect a measurable 4.7% decline in revenue compared to the last year of performance. Statutory earnings per share are forecast to dive 74% to US$0.18 in the same period. Before this earnings report, the analyst had been forecasting revenues of US$239.6m and earnings per share (EPS) of US$0.31 in 2024. It looks like sentiment has declined substantially in the aftermath of these results, with a substantial drop in revenue estimates and a large cut to earnings per share numbers as well.

最新業績公佈後,理查森電子唯一分析師一致認爲,2024年的收入爲2.152億美元,這將反映出與去年業績相比,收入將顯著下降4.7%。預計同期法定每股收益將下降74%,至0.18美元。在這份收益報告之前,分析師一直預測2024年的收入爲2.396億美元,每股收益(EPS)爲0.31美元。這些業績公佈後,市場情緒似乎已大幅下降,收入預期大幅下降,每股收益數字也大幅下調。

The consensus price target fell 62% to US$10.00, with the weaker earnings outlook clearly leading valuation estimates.

共識目標股價下跌62%,至10.00美元,盈利前景疲軟顯然領先於估值預期。

Of course, another way to look at these forecasts is to place them into context against the industry itself. These estimates imply that revenue is expected to slow, with a forecast annualised decline of 9.3% by the end of 2024. This indicates a significant reduction from annual growth of 11% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 5.2% per year. It's pretty clear that Richardson Electronics' revenues are expected to perform substantially worse than the wider industry.

當然,看待這些預測的另一種方法是將它們與行業本身聯繫起來。這些估計表明,收入預計將放緩,預計到2024年底年化下降9.3%。這表明與過去五年11%的年增長率相比大幅下降。相比之下,我們的數據表明,總體而言,同一行業的其他公司的收入預計每年將增長5.2%。很明顯,理查森電子的收入表現預計將大大低於整個行業。

The Bottom Line

底線

The most important thing to take away is that the analyst downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. On the negative side, they also downgraded their revenue estimates, and forecasts imply they will perform worse than the wider industry. The consensus price target fell measurably, with the analyst seemingly not reassured by the latest results, leading to a lower estimate of Richardson Electronics' future valuation.

要了解的最重要的一點是,分析師下調了每股收益的預期,這表明公佈這些業績後,市場情緒明顯下降。不利的一面是,他們還下調了收入預期,預測表明他們的表現將比整個行業差。共識目標股價大幅下降,最新業績似乎並未使分析師放心,導致對理查森電子未來估值的估計降低。

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Richardson Electronics going out as far as 2025, and you can see them free on our platform here.

根據這種思路,我們認爲該業務的長期前景比明年的收益重要得多。根據分析師的估計,理查森電子的上市時間將持續到2025年,你可以在我們的平台上免費查看。

Plus, you should also learn about the 2 warning signs we've spotted with Richardson Electronics .

另外,你還應該了解我們在理查森電子身上發現的兩個警告信號。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章並非旨在提供財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不會考慮最新的價格敏感型公司公告或定性材料。華爾街只是沒有持有上述任何股票的頭寸。

The consensus price target fell 62% to US$10.00, with the weaker earnings outlook clearly leading valuation estimates.

The consensus price target fell 62% to US$10.00, with the weaker earnings outlook clearly leading valuation estimates.