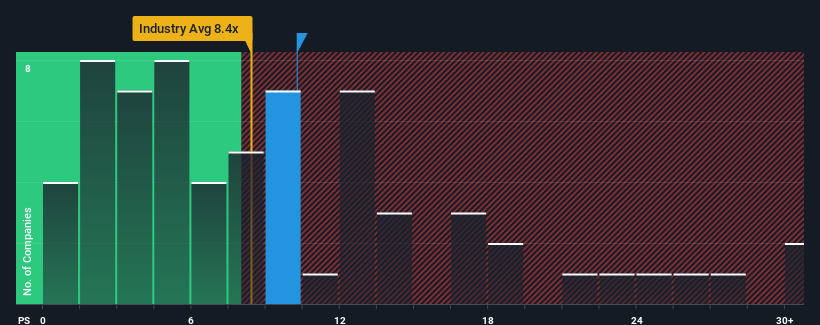

With a price-to-sales (or "P/S") ratio of 10.3x Chengdu JOUAV Automation Tech Co.,Ltd. (SHSE:688070) may be sending bearish signals at the moment, given that almost half of all Aerospace & Defense companies in China have P/S ratios under 8.4x and even P/S lower than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Chengdu JOUAV Automation TechLtd

What Does Chengdu JOUAV Automation TechLtd's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Chengdu JOUAV Automation TechLtd's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Chengdu JOUAV Automation TechLtd will help you uncover what's on the horizon.How Is Chengdu JOUAV Automation TechLtd's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Chengdu JOUAV Automation TechLtd's to be considered reasonable.

There's an inherent assumption that a company should outperform the industry for P/S ratios like Chengdu JOUAV Automation TechLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.3%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 20% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 83% over the next year. With the industry only predicted to deliver 48%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Chengdu JOUAV Automation TechLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Chengdu JOUAV Automation TechLtd shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Chengdu JOUAV Automation TechLtd is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.