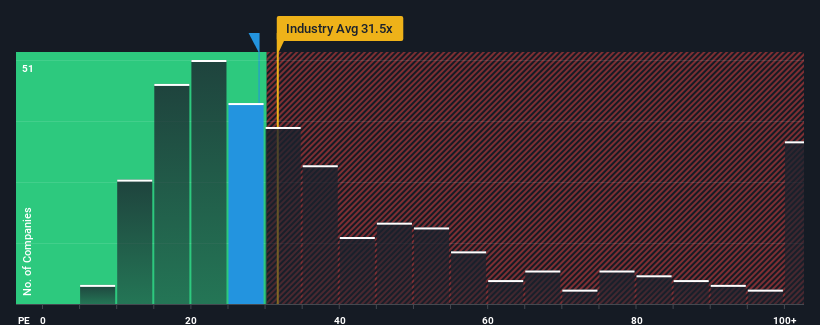

With a price-to-earnings (or "P/E") ratio of 29.1x Bosun Co., Ltd. (SZSE:002282) may be sending bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 34x and even P/E's higher than 62x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

For example, consider that Bosun's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Bosun

How Is Bosun's Growth Trending?

In order to justify its P/E ratio, Bosun would need to produce sluggish growth that's trailing the market.

In order to justify its P/E ratio, Bosun would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 15% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 43% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that Bosun's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Bosun revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Bosun with six simple checks will allow you to discover any risks that could be an issue.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.