When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. For instance, the price of Nanfang Black Sesame Group Co.,Ltd. (SZSE:000716) stock is up an impressive 114% over the last five years. And in the last week the share price has popped 10%.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for Nanfang Black Sesame GroupLtd

Nanfang Black Sesame GroupLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last half decade Nanfang Black Sesame GroupLtd's revenue has actually been trending down at about 6.9% per year. On the other hand, the share price done the opposite, gaining 16%, compound, each year. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, we are a bit cautious in this kind of situation.

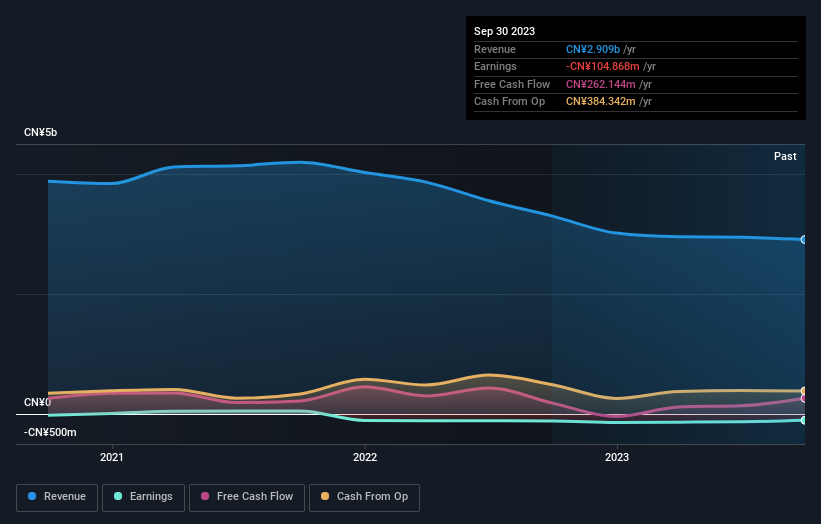

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that Nanfang Black Sesame GroupLtd shareholders are down 29% for the year. Unfortunately, that's worse than the broader market decline of 15%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 16% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Nanfang Black Sesame GroupLtd better, we need to consider many other factors. For instance, we've identified 2 warning signs for Nanfang Black Sesame GroupLtd (1 is significant) that you should be aware of.

We will like Nanfang Black Sesame GroupLtd better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.