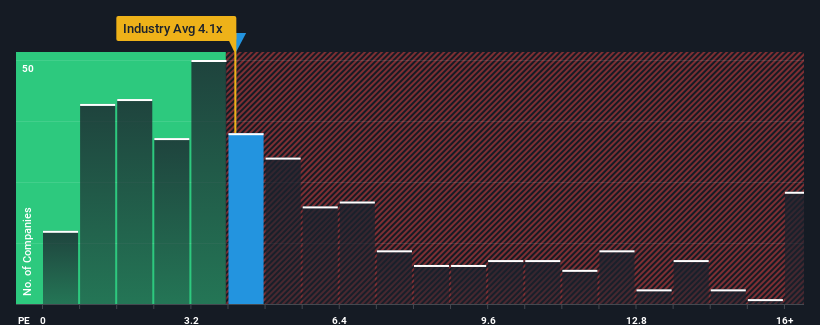

It's not a stretch to say that Shenzhen Fastprint Circuit Tech Co.,Ltd.'s (SZSE:002436) price-to-sales (or "P/S") ratio of 4.1x seems quite "middle-of-the-road" for Electronic companies in China, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Shenzhen Fastprint Circuit TechLtd

How Shenzhen Fastprint Circuit TechLtd Has Been Performing

Shenzhen Fastprint Circuit TechLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Shenzhen Fastprint Circuit TechLtd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

Shenzhen Fastprint Circuit TechLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Shenzhen Fastprint Circuit TechLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.2%. Regardless, revenue has managed to lift by a handy 28% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 37% each year over the next three years. With the industry only predicted to deliver 18% each year, the company is positioned for a stronger revenue result.

In light of this, it's curious that Shenzhen Fastprint Circuit TechLtd's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Shenzhen Fastprint Circuit TechLtd currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Shenzhen Fastprint Circuit TechLtd (at least 1 which can't be ignored), and understanding them should be part of your investment process.

If you're unsure about the strength of Shenzhen Fastprint Circuit TechLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.