當隨處都是低價,價格就不再是最大的優勢。

“預計2023年歸屬於上市公司股東的淨利潤2億元~2.2億元,同比增長54.97%~70.47%。”

“2024年貨節期間,三隻松鼠禮盒/禮包類產品線下分銷火爆程度遠超預期,產品已全線售罄。”

三隻松鼠的經營終於傳來喜訊。

三隻松鼠的經營終於傳來喜訊。

關於產品銷售火熱、業績預增的原因,公司將其歸功於“高端性價比”政策。這也是繼良品鋪子以價換量取得顯著成效,另一老牌零食企業在降價自救中看到了希望。

零食行業正圍繞着低價與新舊業態之間展開一輪又一輪的激烈爭鋒。

可以預見的是,2024年,低價策略依然是以三隻松鼠、良品鋪子爲代表的品牌商與零食很忙、萬辰集團爲代表的渠道商所追逐的共同目標。

不過,值得思考的是,當所有產品朝着低價趨勢發展,價格還是最具競爭力的優勢嗎?當低價成爲行業共識,這個門檻較低的行業又有哪些護城河?

從天貓頭牌到抖音頭牌,三隻松鼠憑什麼?

2023年低價如一陣風,成爲貫穿零售的主旋律。年輕人網購時不再將淘寶、京東作爲首選,他們習慣上拼多多百億補貼、在抖音看直播下單;名創優品的白牌雜貨也能爲他們提供小確幸;在線下,在盒馬、奧樂齊買自由品牌的“性價比”更成爲流行。

市場普遍形成了一種共識:面對供大於求以及經濟放緩的壓力,“品牌”、“溢價”已經無法再打動消費者,未來零售將回歸本質——即以用最低的成本、最高的效率完成商品流通。

當面對低效率渠道向高效率渠道轉變的不可逆趨勢時,零食品牌商們也走上了不同的道路。

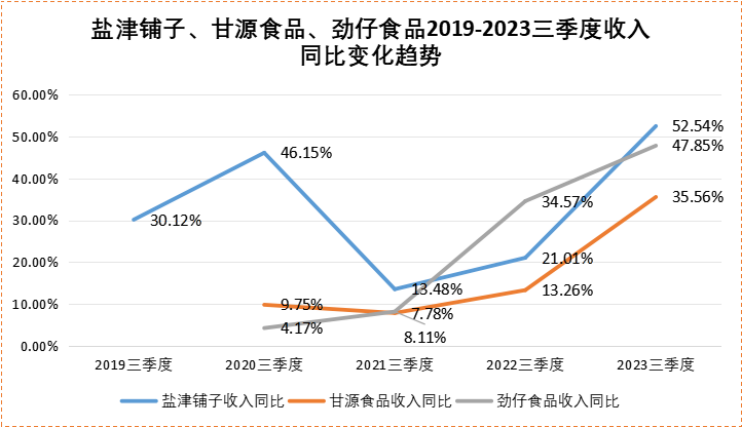

其中不乏像鹽津鋪子、勁仔食品、甘源食品等靈活轉型,迅速抓住了零食折扣店增長紅利的上游廠商。

這三家公司在近期業績會中都特別強調了零食折扣業態爲利潤增長做出的貢獻,其中鹽津鋪子早在2022年年報中便提到了零食量販業態對業績增長的積極影響,如今零食連鎖渠道銷售佔比已超過15%。

(見智研究自制圖)

在勁仔食品最近發佈的2023業績預告中,透露出公司營收突破20億元,成功實現上市後“三年倍增”的階段性目標。在總結業績原因時,零食量販、新媒體電商等新興渠道再次成爲不容忽視的關鍵因素。

零食量販業態的崛起爲早早轉型、擁抱新渠道的零食廠商提供了新的增量,然而,對於一些傳統零食品牌如良品鋪子、三隻松鼠、來伊份造成了更大的衝擊。換言之,對於那些未能及時轉型,仍依賴品牌溢價傳統路徑的品牌來說生存環境變得更加艱難。

(良品鋪子、三隻松鼠、來伊份近些年都面臨銷售費用居高不下,盈利能力走弱的問題,見智研究自制圖)

爲了扭轉業績的頹勢,這些傳統零食品牌也不得不想辦法自保了。

一向以高端化自居的良品鋪子率先採取了降價策略。頗有意思的是,良品鋪子價格調整後不久,三隻松鼠創始人章燎原就跳出來說自己早在一年前就實行了“高端性價比”政策。這一喊話也成功讓市場目光再次聚集到這一同樣面臨危機的傳統零食品牌上。

三隻松鼠過去的業績可以用“成也電商、敗也電商”來概括。

2012年,三隻松鼠乘着電商紅利在互聯網上迅速嶄露頭角,穩居多年天貓“頭牌”。然而隨着電商紅利的減弱,三隻松鼠不僅仍困守於流量爲核心的經營模式,還從原本立足於天貓等互聯網銷售起家的性價比轉向了高品牌溢價方向,大舉投入資金開設線下門店,這也導致了後期的大規模關店潮,淨利潤從2021年的4.11億急劇下降至1.29億。

與此同時,對抖音、直播等新型電商平台的忽視使得三隻松鼠在競爭中失去了市場份額,被衆多白牌和其他品牌搶佔。

直到2022年末,三隻松鼠意識到打法需要變了,由此開啓了長達一年多的“高端性價比”戰略。

然而,降價並非輕鬆之舉,零售端價格的變動背後牽扯到的是供應鏈、物流運輸、原材料採購等環節利潤的再分配,若只降價不提升效率,可能面臨更不賺錢的風險。

要如何實現“高端”和“性價比”兩個看似矛盾的概念,以章燎原的話來說,三隻松鼠要效仿山姆的硬折扣,即不以犧牲產品質量的手段降價。

自有品牌被視爲最佳路徑。在三隻松鼠看來,自有品牌的優化不僅在於中間環節成本的控制,還可以通過深入商品原料和配方的端口進行優化,也是對產品質量的一種保證。

當下,各品牌、各渠道紛紛以“低價”爲競爭優勢,價格差異化逐漸消失,機會便會逐漸轉向競爭天平的另一側——品質。

這也是零食量販渠道的短板所在——沒有自有供應鏈,產品主要依賴於上游供應鏈的大規模採購,對品質難以做到強把控。

相比之下,良品鋪子、三隻松鼠等品牌商更加註重品牌建設,與上游原料端保持更爲緊密的聯繫,也在消費者心目中具備更強品牌認知。這也解釋了爲何三隻松鼠、良品鋪子的大單品一旦降價,銷售額便迅速飆升。

(圖片來源:小紅書)

如三隻松鼠爆品夏威夷果產品通過自建工廠生產,疊加流通環節的成本優化後,23年的價格比22年降低了30%,門店售價爲26.39元/斤,遠低於趙一鳴零食店45.38元/斤的價格(按甘源芥末味夏威夷果5.9元/65g價格覈算)。

當品牌賣的比折扣店的售價還低,消費者又會怎麼選呢?

從數據上看,2023年三隻松鼠的轉型取得了初步成績。根據1月15日的業績預告,公司預計2023年的盈利將達到2億元至2.2億元,同比增長54.97%至70.47%,且截至1月15日,公司2024年貨節銷售已經完成三分之二,全渠道銷售額已經超過去年年貨節的總銷售額,表現勢頭十分強勁。

同時,三隻松鼠正在回到電商老本行,尤其專注於更高流量的直播電商渠道。三隻松鼠曾向媒體透露,自2023年4月至年底的8個月內,三隻松鼠與超過30萬名帶貨達人展開過合作,抖音達人分銷業務爲公司貢獻了逾40億元的銷售額;抖音自播銷售額實現了百分之百的增長,達播和商城的增長率分別達到了800%和1000%。

在一季度年貨備貨旺季,三隻松鼠加大了在抖音的投入,通過邀請賈乃亮、辛巴等頭部明星主播專場直播的方式,成功推動公司在抖快渠道的銷售進一步上升。根據券商數據,1月6日至12日期間,三隻松鼠的達播總GMV達到2.1億元,其中賈乃亮宣佈代言後首個專場的總銷售額超過1.1億元。

從曾經的“天貓頭牌”到“抖音頭牌”,三隻松鼠們正在奪回失去的市場。

三只松鼠的经营终于传来喜讯。

三只松鼠的经营终于传来喜讯。