Enanta Pharmaceuticals, Inc. (NASDAQ:ENTA) shareholders have had their patience rewarded with a 29% share price jump in the last month. But the last month did very little to improve the 76% share price decline over the last year.

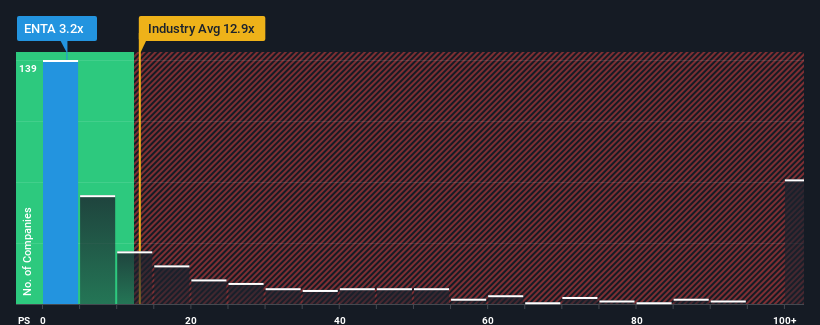

Even after such a large jump in price, Enanta Pharmaceuticals' price-to-sales (or "P/S") ratio of 3.2x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 12.9x and even P/S above 51x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Enanta Pharmaceuticals

How Has Enanta Pharmaceuticals Performed Recently?

Enanta Pharmaceuticals could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Enanta Pharmaceuticals could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Is There Any Revenue Growth Forecasted For Enanta Pharmaceuticals?

In order to justify its P/S ratio, Enanta Pharmaceuticals would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 8.1% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 35% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue growth is heading into negative territory, declining 0.7% per year over the next three years. Meanwhile, the broader industry is forecast to expand by 239% each year, which paints a poor picture.

With this information, we are not surprised that Enanta Pharmaceuticals is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Enanta Pharmaceuticals' P/S

Shares in Enanta Pharmaceuticals have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's clear to see that Enanta Pharmaceuticals maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Enanta Pharmaceuticals' poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Enanta Pharmaceuticals you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.