Earnings Not Telling The Story For New Jersey Resources Corporation (NYSE:NJR)

Earnings Not Telling The Story For New Jersey Resources Corporation (NYSE:NJR)

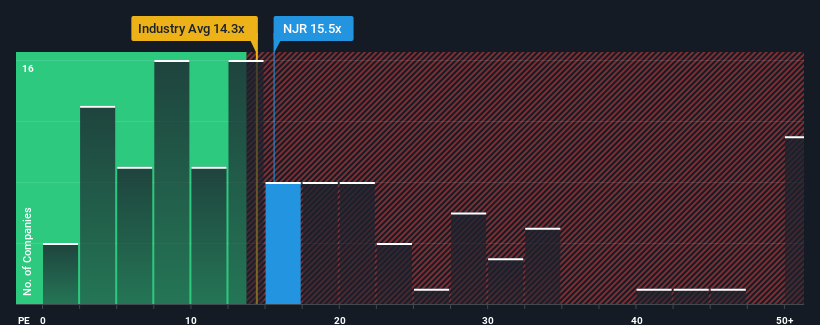

It's not a stretch to say that New Jersey Resources Corporation's (NYSE:NJR) price-to-earnings (or "P/E") ratio of 15.5x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 16x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

可以毫不誇張地說,與市盈率中位數約爲16倍的美國市場相比,新澤西資源公司(紐約證券交易所代碼:NJR)15.5倍的市盈率(或 “市盈率”)目前似乎相當 “處於中間位置”。但是,不加解釋地忽略市盈率是不明智的,因爲投資者可能無視一個特殊的機會或一個代價高昂的錯誤。

New Jersey Resources has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

由於其收益的下降速度快於大多數其他公司,新澤西資源最近一直處於困境。一種可能性是市盈率適中,因爲投資者認爲該公司的收益趨勢最終將與市場上大多數其他公司的收益趨勢一致。如果你仍然相信公司的業務,你寧願公司不流失收益。或者,至少,如果你的計劃是在股市不利的情況下買入一些股票,你會希望它不會一直表現不佳。

See our latest analysis for New Jersey Resources

查看我們對新澤西資源的最新分析

NYSE:NJR Price to Earnings Ratio vs Industry January 18th 2024

紐約證券交易所:NJR 對比行業的市盈率 2024 年 1 月 18 日

Keen to find out how analysts think New Jersey Resources' future stacks up against the industry? In that case, our free report is a great place to start.

想了解分析師如何看待新澤西資源的未來與該行業的對立嗎?在這種情況下,我們的免費報告是一個很好的起點。

Does Growth Match The P/E?

增長與市盈率相匹配嗎?

New Jersey Resources' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

新澤西資源的市盈率對於一家預計只會實現適度增長且重要的是表現與市場保持一致的公司來說是典型的。

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 4.6%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 57% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

如果我們回顧一下去年的收益,令人沮喪的是,該公司的利潤下降了4.6%。但是,在此之前的幾年非常強勁,這意味着它在過去三年中仍然能夠將每股收益總額增長57%,令人印象深刻。因此,我們可以首先確認該公司在此期間在增加收益方面總體上做得非常出色,儘管在此過程中遇到了一些小問題。

Turning to the outlook, the next three years should generate growth of 5.0% per annum as estimated by the five analysts watching the company. That's shaping up to be materially lower than the 12% per annum growth forecast for the broader market.

展望來看,根據關注該公司的五位分析師的估計,未來三年將實現每年5.0%的增長。這將大大低於整個市場預期的12%的年增長率。

With this information, we find it interesting that New Jersey Resources is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

有了這些信息,我們發現有趣的是,新澤西資源的交易市盈率與市場相當相似。顯然,該公司的許多投資者沒有分析師所表示的那麼看跌,並且不願意立即放棄股票。維持這些價格將很難實現,因爲這種收益增長水平最終可能會壓低股價。

What We Can Learn From New Jersey Resources' P/E?

我們可以從新澤西資源的市盈率中學到什麼?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

我們可以說,市盈率的力量主要不是作爲估值工具,而是衡量當前投資者情緒和未來預期。

We've established that New Jersey Resources currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

我們已經確定,新澤西資源目前的市盈率高於預期,因爲其預測的增長低於整個市場。當我們看到疲軟的盈利前景且低於市場增長速度時,我們懷疑股價有下跌的風險,從而使溫和的市盈率走低。這使股東的投資處於風險之中,潛在投資者面臨支付不必要的溢價的危險。

We don't want to rain on the parade too much, but we did also find 2 warning signs for New Jersey Resources (1 is concerning!) that you need to be mindful of.

我們不想在遊行隊伍中下太多雨,但我們還發現了新澤西資源的 2 個警告標誌(1 個令人擔憂!)你需要注意的。

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

如果你對市盈率感興趣,你可能希望看到這批盈利增長強勁、市盈率低的免費公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接聯繫我們。或者,也可以發送電子郵件至編輯團隊 (at) simplywallst.com。

Simply Wall St 的這篇文章本質上是籠統的。我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章並非旨在提供財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不會考慮最新的價格敏感型公司公告或定性材料。華爾街只是沒有持有上述任何股票的頭寸。

NYSE:NJR Price to Earnings Ratio vs Industry January 18th 2024

NYSE:NJR Price to Earnings Ratio vs Industry January 18th 2024