Despite an already strong run, SDM Education Group Holdings Limited (HKG:8363) shares have been powering on, with a gain of 29% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 18% in the last twelve months.

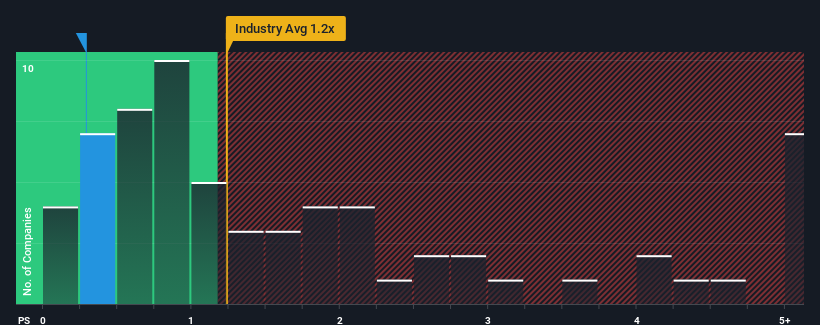

Even after such a large jump in price, it would still be understandable if you think SDM Education Group Holdings is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in Hong Kong's Consumer Services industry have P/S ratios above 1.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for SDM Education Group Holdings

How Has SDM Education Group Holdings Performed Recently?

For example, consider that SDM Education Group Holdings' financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on SDM Education Group Holdings will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

For example, consider that SDM Education Group Holdings' financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on SDM Education Group Holdings will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Is There Any Revenue Growth Forecasted For SDM Education Group Holdings?

There's an inherent assumption that a company should underperform the industry for P/S ratios like SDM Education Group Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 6.7% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 14% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 19% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why SDM Education Group Holdings is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What We Can Learn From SDM Education Group Holdings' P/S?

The latest share price surge wasn't enough to lift SDM Education Group Holdings' P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of SDM Education Group Holdings revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It is also worth noting that we have found 4 warning signs for SDM Education Group Holdings (3 can't be ignored!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.