It's not possible to invest over long periods without making some bad investments. But really big losses can really drag down an overall portfolio. So consider, for a moment, the misfortune of Yixin Group Limited (HKG:2858) investors who have held the stock for three years as it declined a whopping 82%. That'd be enough to cause even the strongest minds some disquiet. And more recent buyers are having a tough time too, with a drop of 51% in the last year. The falls have accelerated recently, with the share price down 18% in the last three months. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Yixin Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Yixin Group became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

Revenue is actually up 34% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Yixin Group more closely, as sometimes stocks fall unfairly. This could present an opportunity.

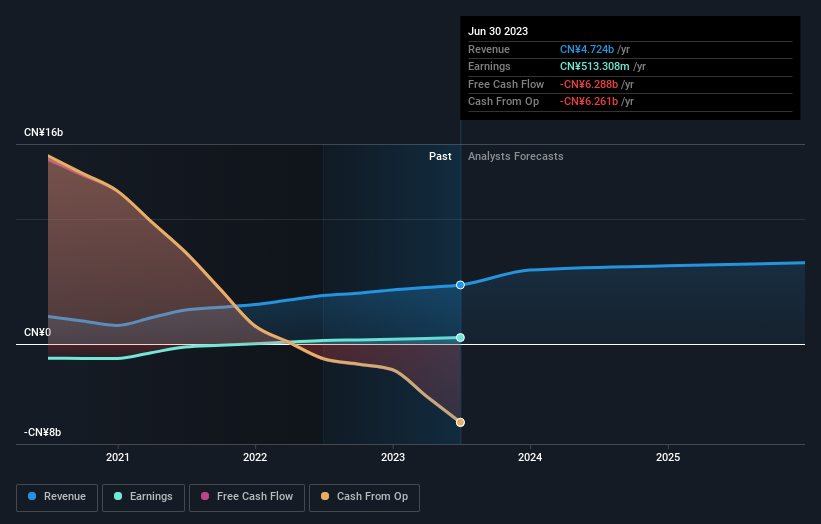

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Yixin Group has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Yixin Group's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 19% in the twelve months, Yixin Group shareholders did even worse, losing 50% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Yixin Group you should be aware of, and 2 of them shouldn't be ignored.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.