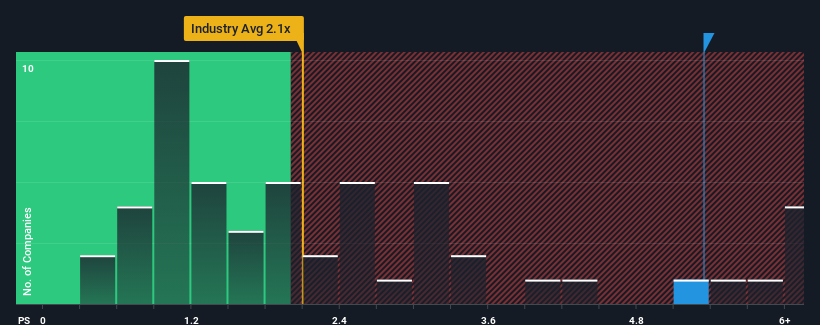

When you see that almost half of the companies in the Building industry in China have price-to-sales ratios (or "P/S") below 2.1x, Zhejiang Tianzhen Technology Co., Ltd. (SZSE:301356) looks to be giving off strong sell signals with its 5.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Zhejiang Tianzhen Technology

What Does Zhejiang Tianzhen Technology's P/S Mean For Shareholders?

Recent times haven't been great for Zhejiang Tianzhen Technology as its revenue has been falling quicker than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zhejiang Tianzhen Technology.How Is Zhejiang Tianzhen Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Zhejiang Tianzhen Technology would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Zhejiang Tianzhen Technology would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 77%. This means it has also seen a slide in revenue over the longer-term as revenue is down 69% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 339% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Zhejiang Tianzhen Technology's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Zhejiang Tianzhen Technology shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Zhejiang Tianzhen Technology that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.