- 要聞

- 投資者沒有買入長源科技集團有限公司。”(SHSE: 600525) 收入

Investors Aren't Buying Changyuan Technology Group Ltd.'s (SHSE:600525) Revenues

Investors Aren't Buying Changyuan Technology Group Ltd.'s (SHSE:600525) Revenues

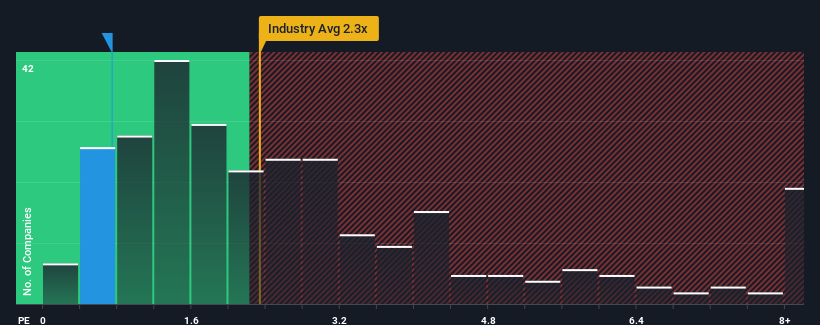

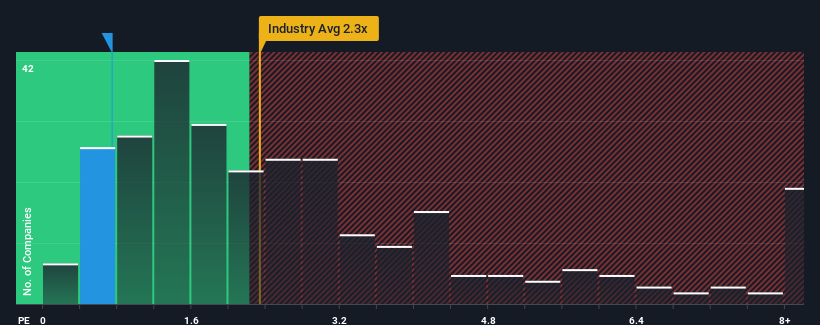

Changyuan Technology Group Ltd.'s (SHSE:600525) price-to-sales (or "P/S") ratio of 0.7x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Electrical industry in China have P/S ratios greater than 2.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Changyuan Technology Group

What Does Changyuan Technology Group's P/S Mean For Shareholders?

Changyuan Technology Group has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Changyuan Technology Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Changyuan Technology Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Changyuan Technology Group's Revenue Growth Trending?

In order to justify its P/S ratio, Changyuan Technology Group would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Changyuan Technology Group would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 15% last year. The solid recent performance means it was also able to grow revenue by 26% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing that to the industry, which is predicted to deliver 29% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's understandable that Changyuan Technology Group's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Changyuan Technology Group's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Changyuan Technology Group confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

You always need to take note of risks, for example - Changyuan Technology Group has 1 warning sign we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

長源科技集團有限公司s(SHSE: 600525)0.7倍的市銷率(或 “市盈率”)可能看起來是一個非常有吸引力的投資機會,因爲中國電氣行業將近一半的公司的市銷率大於2.3倍。但是,僅按面值計算市銷率是不明智的,因爲可以解釋其有限的原因。

查看我們對長源科技集團的最新分析

長源科技集團的市銷率對股東意味着什麼?

長源科技集團最近表現良好,收入穩步增長。一種可能性是市銷率很低,因爲投資者認爲這種可觀的收入增長在不久的將來實際上可能低於整個行業。那些看好長源科技集團的人希望情況並非如此,這樣他們就可以以較低的估值買入該股。

儘管尚無分析師對長源科技集團的估計,但請看一下這個免費的數據豐富的可視化圖表,看看該公司的收益、收入和現金流是如何積累的。長源科技集團的收入增長趨勢如何?

爲了證明其市銷率是合理的,長源科技集團需要實現落後於該行業的緩慢增長。

爲了證明其市銷率是合理的,長源科技集團需要實現落後於該行業的緩慢增長。

首先回顧一下,我們發現該公司去年的收入成功增長了15%。最近的穩健表現意味着它在過去三年中總收入增長了26%。因此,可以公平地說,該公司最近的收入增長是可觀的。

根據最近的中期年化收入業績,該行業預計將在未來12個月內實現29%的增長,相比之下,該公司的勢頭較弱。

有鑑於此,長源科技集團的市銷率低於其他多數公司是可以理解的。顯然,許多股東不願意堅持他們認爲將繼續落後於整個行業的東西。

長源科技集團市銷率的底線

儘管市銷率不應該成爲決定你是否買入股票的決定性因素,但它是衡量收入預期的有力晴雨表。

我們對長源科技集團的審查證實,正如我們所懷疑的那樣,該公司過去三年的收入趨勢是其低市銷售率的關鍵因素,因爲這些趨勢未達到當前的行業預期。在現階段,投資者認爲,收入改善的可能性不足以證明更高的市銷率是合理的。如果最近的中期收入趨勢繼續下去,就很難看到股價在短期內出現命運逆轉。

你需要時刻注意風險,例如——長源科技集團有1個我們認爲你應該注意的警告標誌。

如果你喜歡實力雄厚的公司盈利,那麼你會想看看這份以低市盈率(但已證明可以增加收益)的有趣公司的免費名單。

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧