It's easy to feel disappointed if you buy a stock that goes down. But sometimes a share price fall can have more to do with market conditions than the performance of the specific business. Over the year the Conch (Anhui) Energy Saving and Environment Protection New Material Co., Ltd. (SZSE:000619) share price fell 12%. But that actually beats the market decline of 21%. Longer term investors have fared much better, since the share price is up 12% in three years. The last week also saw the share price slip down another 15%. However, this move may have been influenced by the broader market, which fell 6.3% in that time.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Conch (Anhui) Energy Saving and Environment Protection New Material

Because Conch (Anhui) Energy Saving and Environment Protection New Material made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Because Conch (Anhui) Energy Saving and Environment Protection New Material made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

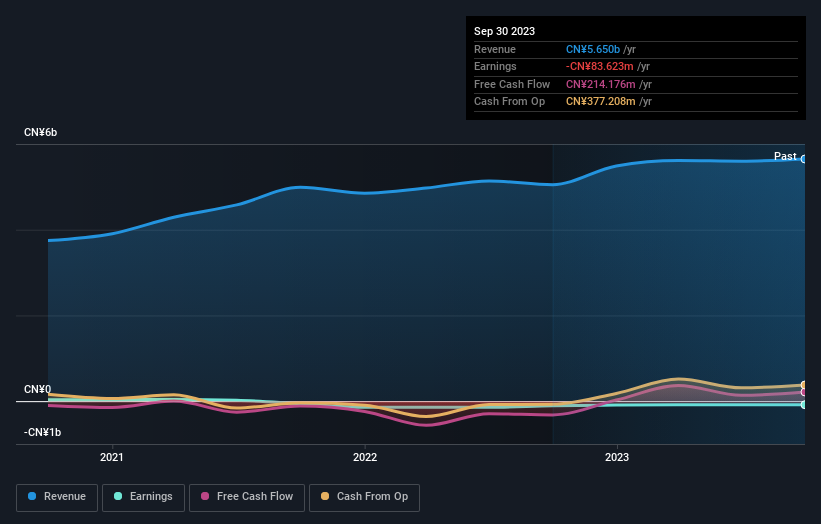

In the last year Conch (Anhui) Energy Saving and Environment Protection New Material saw its revenue grow by 12%. That's not a very high growth rate considering it doesn't make profits. While the stock is down 12% over the last twelve months, that's not bad in this market. So it looks like shareholders aren't caving in to fear at this time. This can be a sign that they are confident profits will flow. Are you?.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Conch (Anhui) Energy Saving and Environment Protection New Material's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While it's never nice to take a loss, Conch (Anhui) Energy Saving and Environment Protection New Material shareholders can take comfort that their trailing twelve month loss of 12% wasn't as bad as the market loss of around 21%. Longer term investors wouldn't be so upset, since they would have made 2%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Conch (Anhui) Energy Saving and Environment Protection New Material is showing 2 warning signs in our investment analysis , and 1 of those is a bit concerning...

But note: Conch (Anhui) Energy Saving and Environment Protection New Material may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.