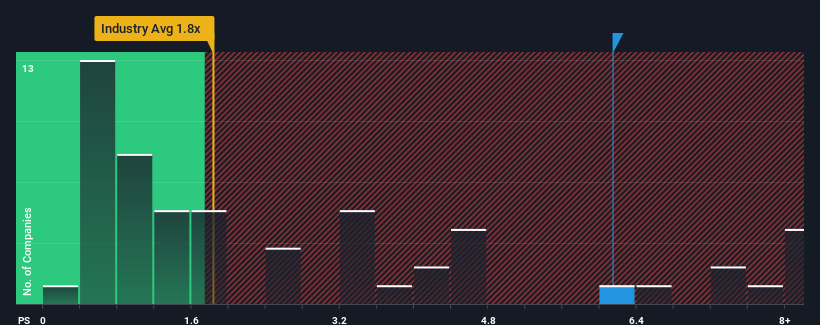

Henan BCCY Environmental Energy Co., Ltd's (SZSE:300614) price-to-sales (or "P/S") ratio of 6.1x may look like a poor investment opportunity when you consider close to half the companies in the Renewable Energy industry in China have P/S ratios below 1.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Henan BCCY Environmental Energy

How Henan BCCY Environmental Energy Has Been Performing

As an illustration, revenue has deteriorated at Henan BCCY Environmental Energy over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Henan BCCY Environmental Energy will help you shine a light on its historical performance.How Is Henan BCCY Environmental Energy's Revenue Growth Trending?

In order to justify its P/S ratio, Henan BCCY Environmental Energy would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Henan BCCY Environmental Energy would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. As a result, revenue from three years ago have also fallen 20% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to shrink 22% in the next 12 months, the company's downward momentum is still superior based on recent medium-term annualised revenue results.

With this in consideration, it's no surprise that Henan BCCY Environmental Energy's P/S exceeds that of its industry peers. However, even if the company's recent growth rates were to continue outperforming the industry, shrinking revenues are unlikely to make the P/S premium sustainable over the longer term. There is potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What We Can Learn From Henan BCCY Environmental Energy's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Henan BCCY Environmental Energy confirms that the company's less severe contraction in revenue over the past three-year years is a major contributor to its higher than industry P/S, given the industry is set to decline even more. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under any additional threat. We still remain cautious about the company's ability to stay its recent course and avoid revenues slipping in line with the industry. Otherwise, it's hard to see the share price falling strongly in the near future if its outlook remains more positive than the rest of its peers.

Having said that, be aware Henan BCCY Environmental Energy is showing 3 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If these risks are making you reconsider your opinion on Henan BCCY Environmental Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.