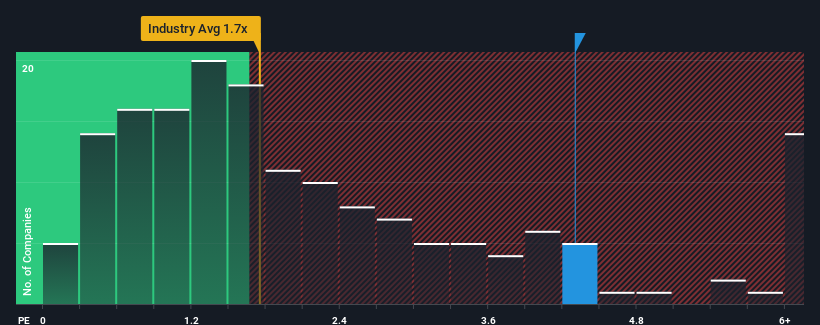

Tianjin Guifaxiang 18th Street Mahua Food Co.,Ltd.'s (SZSE:002820) price-to-sales (or "P/S") ratio of 4.3x may look like a poor investment opportunity when you consider close to half the companies in the Food industry in China have P/S ratios below 1.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Tianjin Guifaxiang 18th Street Mahua FoodLtd

What Does Tianjin Guifaxiang 18th Street Mahua FoodLtd's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Tianjin Guifaxiang 18th Street Mahua FoodLtd has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Tianjin Guifaxiang 18th Street Mahua FoodLtd's earnings, revenue and cash flow.How Is Tianjin Guifaxiang 18th Street Mahua FoodLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Tianjin Guifaxiang 18th Street Mahua FoodLtd's is when the company's growth is on track to outshine the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as steep as Tianjin Guifaxiang 18th Street Mahua FoodLtd's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 66%. Revenue has also lifted 20% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 16% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Tianjin Guifaxiang 18th Street Mahua FoodLtd is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Tianjin Guifaxiang 18th Street Mahua FoodLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Tianjin Guifaxiang 18th Street Mahua FoodLtd (1 shouldn't be ignored) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.