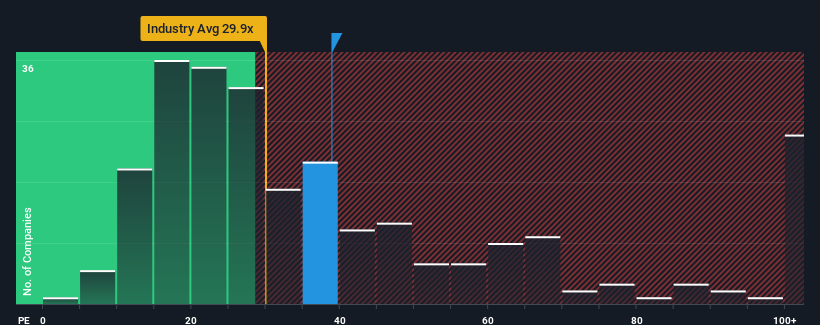

China XD Electric Co., Ltd's (SHSE:601179) price-to-earnings (or "P/E") ratio of 38.9x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 29x and even P/E's below 18x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings that are retreating more than the market's of late, China XD Electric has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for China XD Electric

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as China XD Electric's is when the company's growth is on track to outshine the market.

The only time you'd be truly comfortable seeing a P/E as high as China XD Electric's is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 8.2%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 111% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 43% during the coming year according to the only analyst following the company. Meanwhile, the rest of the market is forecast to expand by 42%, which is not materially different.

In light of this, it's curious that China XD Electric's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From China XD Electric's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that China XD Electric currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - China XD Electric has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.