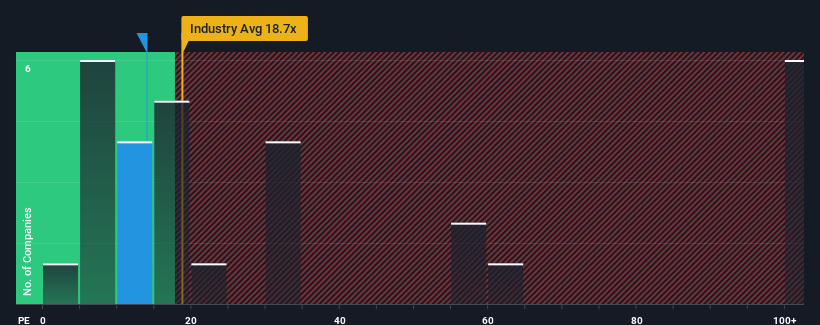

With a price-to-earnings (or "P/E") ratio of 14x Shandong Yulong Gold Co., Ltd. (SHSE:601028) may be sending very bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 55x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been pleasing for Shandong Yulong Gold as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Shandong Yulong Gold

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Shandong Yulong Gold's is when the company's growth is on track to lag the market decidedly.

The only time you'd be truly comfortable seeing a P/E as depressed as Shandong Yulong Gold's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 168% last year. The latest three year period has also seen an excellent 306% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 13% over the next year. Meanwhile, the rest of the market is forecast to expand by 42%, which is noticeably more attractive.

In light of this, it's understandable that Shandong Yulong Gold's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Shandong Yulong Gold's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Shandong Yulong Gold's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Shandong Yulong Gold with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.