Investors in Hla Group (SHSE:600398) Have Seen Favorable Returns of 48% Over the Past Year

Investors in Hla Group (SHSE:600398) Have Seen Favorable Returns of 48% Over the Past Year

The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. For example, the Hla Group Corp., Ltd. (SHSE:600398) share price is up 38% in the last 1 year, clearly besting the market decline of around 22% (not including dividends). So that should have shareholders smiling. However, the longer term returns haven't been so impressive, with the stock up just 15% in the last three years.

投資股票的最簡單方法是購買交易所交易基金。但是,如果你選擇正確的個股,你的收入可能不止於此。例如,Hla集團有限公司(SHSE: 600398)的股價在過去1年中上漲了38%,明顯超過了市場約22%(不包括股息)的跌幅。因此,這應該讓股東們微笑。但是,長期回報並不那麼令人印象深刻,該股在過去三年中僅上漲了15%。

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

考慮到這一點,值得一看公司的基本面是否是長期業績的驅動力,或者是否存在一些差異。

See our latest analysis for Hla Group

查看我們對 Hla Group 的最新分析

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

用本傑明·格雷厄姆的話來說:從短期來看,市場是一臺投票機器,但從長遠來看,它是一臺稱重機。通過比較每股收益(EPS)和一段時間內的股價變化,我們可以了解投資者對公司的態度是如何隨着時間的推移而變化的。

During the last year Hla Group grew its earnings per share (EPS) by 27%. The share price gain of 38% certainly outpaced the EPS growth. So it's fair to assume the market has a higher opinion of the business than it a year ago.

去年,Hla集團的每股收益(EPS)增長了27%。38%的股價漲幅無疑超過了每股收益的增長。因此,可以公平地假設市場對該業務的看法比一年前更高。

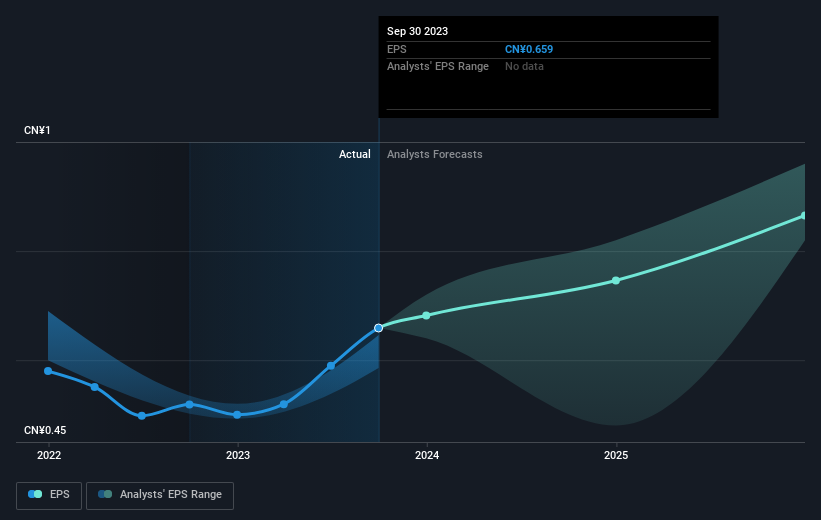

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

下圖描述了 EPS 隨着時間的推移是如何變化的(點擊圖片可以看到確切的值)。

We know that Hla Group has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

我們知道Hla集團最近提高了利潤,但它會增加收入嗎?如果你感興趣,可以查看這份顯示共識收入預測的免費報告。

What About Dividends?

分紅呢?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Hla Group, it has a TSR of 48% for the last 1 year. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

重要的是要考慮任何給定股票的股東總回報率和股價回報率。股東總回報率包含任何分拆或貼現資本籌集的價值,以及任何股息,前提是股息是再投資的。可以公平地說,股東總回報率爲支付股息的股票提供了更完整的畫面。就Hla集團而言,其在過去一年的股東回報率爲48%。這超過了我們之前提到的其股價回報率。這在很大程度上是其股息支付的結果!

A Different Perspective

不同的視角

It's nice to see that Hla Group shareholders have received a total shareholder return of 48% over the last year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 2% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Hla Group better, we need to consider many other factors. For example, we've discovered 1 warning sign for Hla Group that you should be aware of before investing here.

很高興看到Hla集團的股東在過去一年中獲得了48%的總股東回報率。這包括股息。由於一年期股東總回報率好於五年期股東總回報率(後者爲每年2%),因此該股的表現似乎在最近有所改善。持樂觀態度的人可能會將最近股東總回報率的改善視爲業務本身隨着時間的推移而變得更好。長期跟蹤股價表現總是很有意思的。但是,爲了更好地了解Hla集團,我們需要考慮許多其他因素。例如,我們發現了Hla Group的1個警告信號,在這裏投資之前你應該注意這個信號。

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

如果你像我一樣,那麼你不會想錯過這份業內人士正在收購的成長型公司的免費名單。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

請注意,本文引用的市場回報反映了目前在中國交易所交易的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.