Suzhou Sushi Testing Group Co.,Ltd. (SZSE:300416) shares have had a horrible month, losing 26% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 40% share price drop.

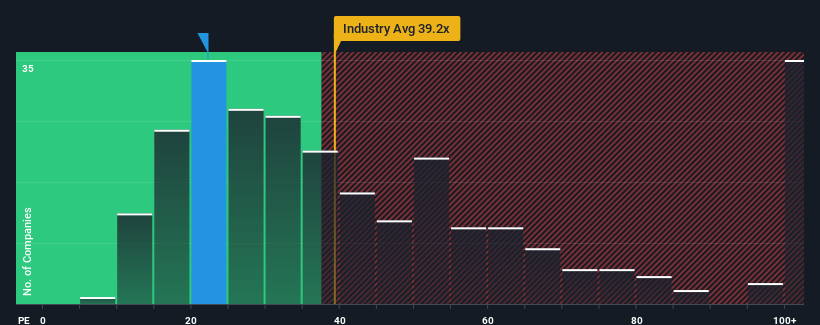

In spite of the heavy fall in price, Suzhou Sushi Testing GroupLtd's price-to-earnings (or "P/E") ratio of 22.2x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 32x and even P/E's above 57x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Suzhou Sushi Testing GroupLtd as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Suzhou Sushi Testing GroupLtd

Check out our latest analysis for Suzhou Sushi Testing GroupLtd

How Is Suzhou Sushi Testing GroupLtd's Growth Trending?

Suzhou Sushi Testing GroupLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 17% last year. Pleasingly, EPS has also lifted 152% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 34% over the next year. That's shaping up to be materially lower than the 42% growth forecast for the broader market.

In light of this, it's understandable that Suzhou Sushi Testing GroupLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Suzhou Sushi Testing GroupLtd's P/E?

The softening of Suzhou Sushi Testing GroupLtd's shares means its P/E is now sitting at a pretty low level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Suzhou Sushi Testing GroupLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Suzhou Sushi Testing GroupLtd that you should be aware of.

You might be able to find a better investment than Suzhou Sushi Testing GroupLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.