What are the top 10 cloud service providers in the world in 2024?

The AI technology competition is no longer just for global technology companies.

Right now, the US Department of Commerce is preparing to “introduce” new regulations” and move towards AI computing power — which will prevent non-US entities from using large US cloud service providers to train big AI models.

Affected by this, the pan-AI concept took a sharp dive. The CPO sector (optical module), as the most beneficial sector for AI, plummeted on Monday.

As of press release, Liante Technology has plummeted by more than 17%, Yitian shares and Jiulian Technology have fallen by more than 14%, Yihua shares have fallen to a halt, and Zhongji Xuchuang and Tianfu Communications have plummeted by more than 9%.

sightingAI big model training

On Friday, US Secretary of Commerce Gina Raimondo said that the Biden administration proposed requiring US cloud service providers to determine whether foreign entities are visiting US data centers to train artificial intelligence models.

Based on this, the US Department of Commerce issued “Taking Additional Steps to Address a National Emergency Concerning Serious Malicious Cyber Activities” for public comment last Friday. It is expected to be released on Monday (January 29, 2024), and the consultation period ends on April 29, 2024.

Major cloud service providers affected by the new regulations include Amazon's AWS, Alphabet's Google Cloud, and Microsoft's Azure.

Over the weekend, US Secretary of Commerce Raymond said that as soon as this week, the Biden administration will require cloud service providers to abide by the new rules to ensure that data centers master customer backgrounds related to artificial intelligence (AI) training activities.

Former US Secretary of State Condoleezza Rice said that the US has begun requiring large cloud service providers to report to the authorities any non-US entity using their devices to train large-scale language models.

Carl Szabo, general counsel for the tech industry organization NetChoice, believes compliance with the proposed “Know Your Customer” directiveInternational cooperation may be hindered.

He believes that the Commerce Department is implementing Biden's “illegal” executive order “to force the industry to meet AI reporting requirements.” He added that requiring US cloud computing companies to report cloud resources “used to train big language models” by non-US entities could hinder international collaboration.

Currently, Microsoft, Amazon, Alphabet, etc. have yet to respond to this.

Agencies:The domestic substitution process is being accelerated

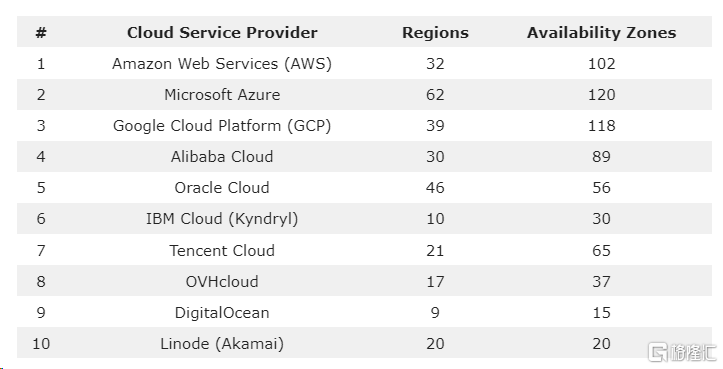

According to the latest statistics from the research institute Dgtl Infra,The top 10 global cloud service providers in 2024 are:Amazon (AWS), Microsoft Azure, Google Cloud, Alibaba Cloud, Oracle Cloud, IBM Cloud (Kyndryl), Tencent Cloud, OVHCloud, DigitalOcean, and Linode (owned by Akamai).

Judging from the country it belongs to,Among the top ten vendors, in addition to 2 Chinese manufacturers, there are 7 US manufacturers. OVHcloud alone is France's cloud giant.

Among them,Amazon is the world's largest cloud service provider. It currently operates in 32 regions and 102 availability zones across the US, AWS GovCloud (US), the Americas, Europe, Asia Pacific, and the Middle East and Africa.

Microsoft Azure is in second place,There are currently 62 regions and 120 availability zones in operation. Microsoft's smart cloud revenue (including revenue from Azure, other cloud services, and server products) reached $24 billion in the latest quarter, up 17% year over year.

Google Cloud ranked third.Currently, Google Cloud operates 39 regions and 118 availability zones. According to the latest quarterly data, Google Cloud's revenue reached $8 billion, up 28% year over year. As a result, Google Cloud generated $32 billion in annual revenue.

Alibaba Cloud is the fourth largest cloud service provider in the world, a major cloud provider in the Asia-Pacific region, and the largest cloud service provider in China. Revenue for the most recent quarter was US$3.5 billion (RMB 25.123 billion), up 4% year over year. As a result, Alibaba Cloud's revenue is currently close to $14 billion on an annualized basis.

Tencent Cloud ranked 7thIt is the second-largest cloud service provider in China, after Alibaba Cloud. Tencent Cloud already operates in 21 regions and 65 availability zones. Including 5 partner regions, the company offers a total of 26 regions and 70 availability zones. In addition to partner regions, Tencent Cloud operates in mainland China, the United States, Canada, Brazil, Germany, India, Indonesia, Japan, Singapore, South Korea, and Thailand.

Regarding the development of domestic optical modules, Southwest Securities analyst Ye Zeyou pointed out that judging from the market competition pattern, domestic optical chip companies occupy the main market share in the 2.5G and below optical chip market; however, the localization rate of high-speed optical chips above 25G is still low. The high-end market is basically monopolized by overseas companies, and the first-mover advantage is remarkable. In recent years, domestic optical chip manufacturers have taken great strides and made major breakthroughs in technology.As the 800G and 1.6T upgrade cycles accelerate, demand for high-speed optical chips is growing rapidly, and overseas production capacity may be limited and the domestic replacement process may be accelerated.

Guotai Junan said that the demand for AI optical modules in 2024 is only at the beginning of the cycle. In December 2023, customs data recorded the highest historical record for China's optical module export value in a single month. China is a major producer of optical modules, and the high growth in customs data strongly supports the boom in optical modules driven by AI.

CITIC Securities also said earlier that with the support of new customers and increased demand for new products, the demand for high-speed optical modules is expected to be fully supported in 2025. The bankWe are optimistic about the continued demand for future high-end optical modules.

Considering the significant increase in technology and production capacity requirements for optical module manufacturers in the context of AI, superposition leading manufacturers are more advanced in the layout of new products such as CPO and LPO, CITIC saidOptimistic that leading manufacturers will continue to maintain their leading positionIn the future, as AI trends and leading advantages continue to be clarified, the bank believes that market-related concerns are expected to be further mitigated, and the market's optimism about rising valuations will gradually increase.