Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies 5i5j Holding Group Co., Ltd. (SZSE:000560) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for 5i5j Holding Group

How Much Debt Does 5i5j Holding Group Carry?

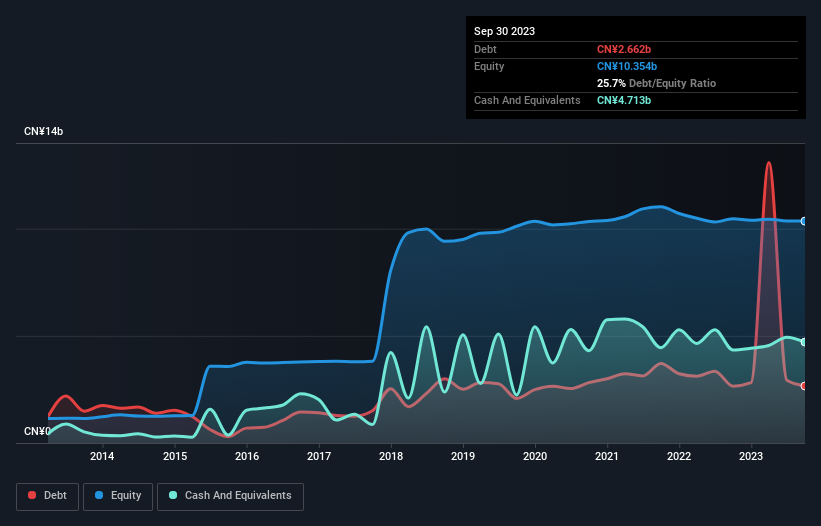

The chart below, which you can click on for greater detail, shows that 5i5j Holding Group had CN¥2.66b in debt in September 2023; about the same as the year before. However, it does have CN¥4.71b in cash offsetting this, leading to net cash of CN¥2.05b.

The chart below, which you can click on for greater detail, shows that 5i5j Holding Group had CN¥2.66b in debt in September 2023; about the same as the year before. However, it does have CN¥4.71b in cash offsetting this, leading to net cash of CN¥2.05b.

A Look At 5i5j Holding Group's Liabilities

According to the last reported balance sheet, 5i5j Holding Group had liabilities of CN¥15.2b due within 12 months, and liabilities of CN¥8.78b due beyond 12 months. Offsetting these obligations, it had cash of CN¥4.71b as well as receivables valued at CN¥6.29b due within 12 months. So its liabilities total CN¥12.9b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the CN¥5.09b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, 5i5j Holding Group would likely require a major re-capitalisation if it had to pay its creditors today. 5i5j Holding Group boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if 5i5j Holding Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, 5i5j Holding Group saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that's not too bad, we'd prefer see growth.

So How Risky Is 5i5j Holding Group?

Although 5i5j Holding Group had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of CN¥3.5b. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. We're not impressed by its revenue growth, so until we see some positive sustainable EBIT, we consider the stock to be high risk. For riskier companies like 5i5j Holding Group I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.