WuXi Xinje Electric Co.,Ltd. (SHSE:603416) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

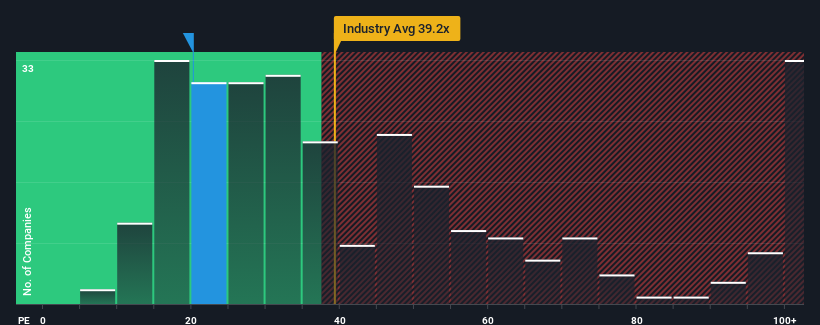

Following the heavy fall in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 32x, you may consider WuXi Xinje ElectricLtd as an attractive investment with its 20.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings that are retreating more than the market's of late, WuXi Xinje ElectricLtd has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for WuXi Xinje ElectricLtd

See our latest analysis for WuXi Xinje ElectricLtd

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, WuXi Xinje ElectricLtd would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 24%. As a result, earnings from three years ago have also fallen 34% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 29% during the coming year according to the two analysts following the company. That's shaping up to be materially lower than the 42% growth forecast for the broader market.

With this information, we can see why WuXi Xinje ElectricLtd is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

The softening of WuXi Xinje ElectricLtd's shares means its P/E is now sitting at a pretty low level. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of WuXi Xinje ElectricLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for WuXi Xinje ElectricLtd that you should be aware of.

Of course, you might also be able to find a better stock than WuXi Xinje ElectricLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.