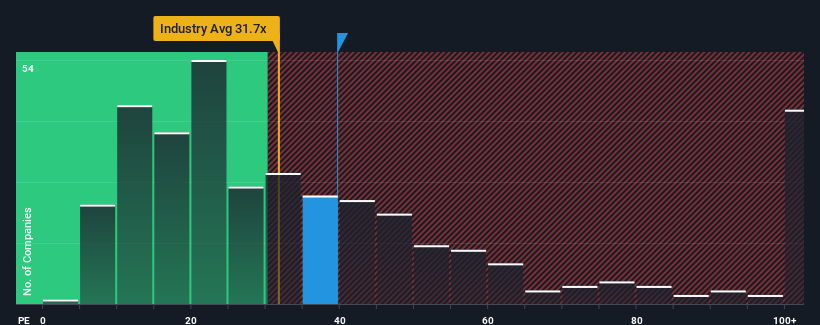

With a price-to-earnings (or "P/E") ratio of 39.6x Shandong Sinocera Functional Material Co., Ltd. (SZSE:300285) may be sending bearish signals at the moment, given that almost half of all companies in China have P/E ratios under 31x and even P/E's lower than 19x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Shandong Sinocera Functional Material has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Shandong Sinocera Functional Material

Is There Enough Growth For Shandong Sinocera Functional Material?

Shandong Sinocera Functional Material's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 26%. As a result, earnings from three years ago have also fallen 17% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 76% as estimated by the analysts watching the company. With the market only predicted to deliver 42%, the company is positioned for a stronger earnings result.

With this information, we can see why Shandong Sinocera Functional Material is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Shandong Sinocera Functional Material maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Shandong Sinocera Functional Material with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.