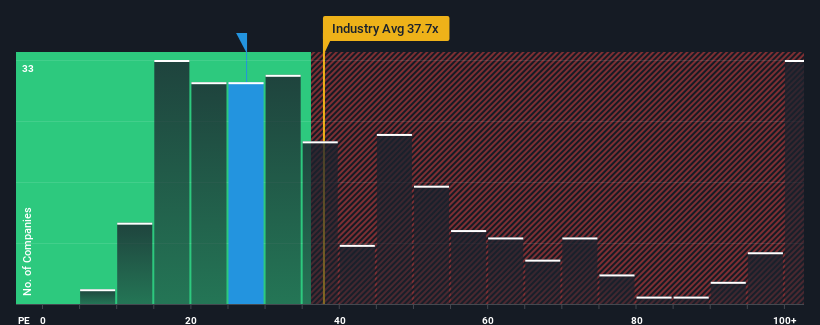

It's not a stretch to say that Willfar Information Technology Co., Ltd.'s (SHSE:688100) price-to-earnings (or "P/E") ratio of 27.4x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 30x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Willfar Information Technology has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Willfar Information Technology

Is There Some Growth For Willfar Information Technology?

There's an inherent assumption that a company should be matching the market for P/E ratios like Willfar Information Technology's to be considered reasonable.

There's an inherent assumption that a company should be matching the market for P/E ratios like Willfar Information Technology's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 25%. The strong recent performance means it was also able to grow EPS by 74% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 31% during the coming year according to the ten analysts following the company. Meanwhile, the rest of the market is forecast to expand by 42%, which is noticeably more attractive.

In light of this, it's curious that Willfar Information Technology's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Willfar Information Technology's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Willfar Information Technology is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.