The Hangzhou Kaierda Welding Robot Co.,Ltd. (SHSE:688255) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 30% share price drop.

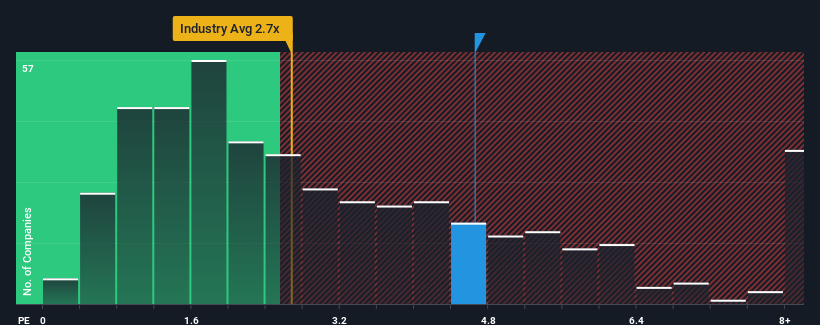

Even after such a large drop in price, given close to half the companies operating in China's Machinery industry have price-to-sales ratios (or "P/S") below 2.7x, you may still consider Hangzhou Kaierda Welding RobotLtd as a stock to potentially avoid with its 4.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Hangzhou Kaierda Welding RobotLtd

How Hangzhou Kaierda Welding RobotLtd Has Been Performing

Revenue has risen at a steady rate over the last year for Hangzhou Kaierda Welding RobotLtd, which is generally not a bad outcome. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Revenue has risen at a steady rate over the last year for Hangzhou Kaierda Welding RobotLtd, which is generally not a bad outcome. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Is There Enough Revenue Growth Forecasted For Hangzhou Kaierda Welding RobotLtd?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Hangzhou Kaierda Welding RobotLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 3.8%. However, this wasn't enough as the latest three year period has seen an unpleasant 28% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 28% shows it's an unpleasant look.

With this in mind, we find it worrying that Hangzhou Kaierda Welding RobotLtd's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Despite the recent share price weakness, Hangzhou Kaierda Welding RobotLtd's P/S remains higher than most other companies in the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Hangzhou Kaierda Welding RobotLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Hangzhou Kaierda Welding RobotLtd (2 shouldn't be ignored!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Hangzhou Kaierda Welding RobotLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.