The Mei Ah Entertainment Group Limited (HKG:391) share price has fared very poorly over the last month, falling by a substantial 26%. Indeed, the recent drop has reduced its annual gain to a relatively sedate 9.6% over the last twelve months.

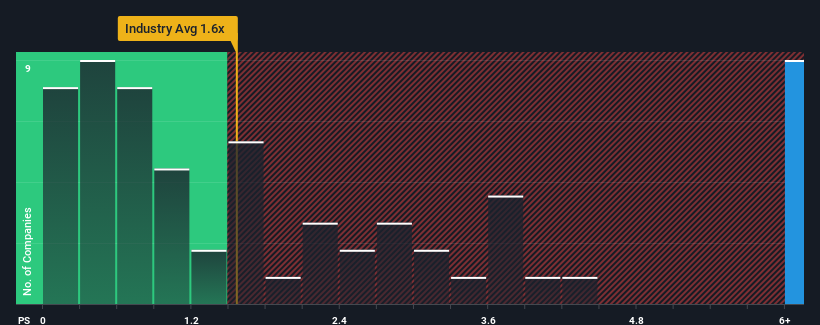

Even after such a large drop in price, when almost half of the companies in Hong Kong's Entertainment industry have price-to-sales ratios (or "P/S") below 1.6x, you may still consider Mei Ah Entertainment Group as a stock not worth researching with its 6.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Mei Ah Entertainment Group

What Does Mei Ah Entertainment Group's Recent Performance Look Like?

Recent times have been quite advantageous for Mei Ah Entertainment Group as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Recent times have been quite advantageous for Mei Ah Entertainment Group as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Is There Enough Revenue Growth Forecasted For Mei Ah Entertainment Group?

The only time you'd be truly comfortable seeing a P/S as steep as Mei Ah Entertainment Group's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 57% gain to the company's top line. Still, revenue has fallen 16% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 45% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Mei Ah Entertainment Group is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

A significant share price dive has done very little to deflate Mei Ah Entertainment Group's very lofty P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Mei Ah Entertainment Group revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Having said that, be aware Mei Ah Entertainment Group is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.