Shenzhen Best of Best Holdings Co.,Ltd. (SZSE:001298) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 25% share price drop.

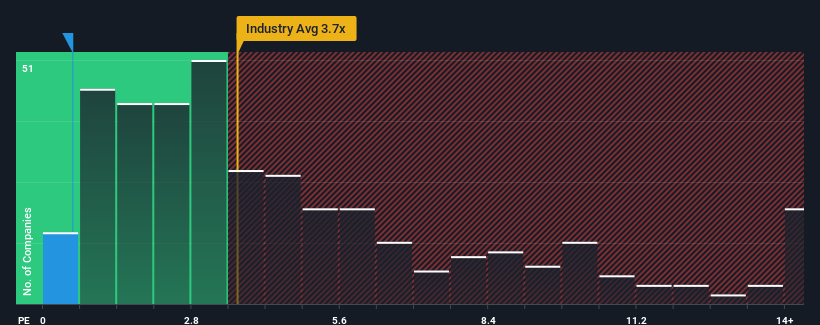

In spite of the heavy fall in price, Shenzhen Best of Best HoldingsLtd's price-to-sales (or "P/S") ratio of 0.6x might still make it look like a strong buy right now compared to the wider Electronic industry in China, where around half of the companies have P/S ratios above 3.7x and even P/S above 7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Shenzhen Best of Best HoldingsLtd

How Has Shenzhen Best of Best HoldingsLtd Performed Recently?

For instance, Shenzhen Best of Best HoldingsLtd's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Shenzhen Best of Best HoldingsLtd will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

For instance, Shenzhen Best of Best HoldingsLtd's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Shenzhen Best of Best HoldingsLtd will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

How Is Shenzhen Best of Best HoldingsLtd's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Shenzhen Best of Best HoldingsLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 5.7% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 60% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Shenzhen Best of Best HoldingsLtd is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What Does Shenzhen Best of Best HoldingsLtd's P/S Mean For Investors?

Shares in Shenzhen Best of Best HoldingsLtd have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shenzhen Best of Best HoldingsLtd confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

There are also other vital risk factors to consider before investing and we've discovered 5 warning signs for Shenzhen Best of Best HoldingsLtd that you should be aware of.

If these risks are making you reconsider your opinion on Shenzhen Best of Best HoldingsLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.