Anhui Tongfeng Electronics Company Limited (SHSE:600237) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 19% share price drop.

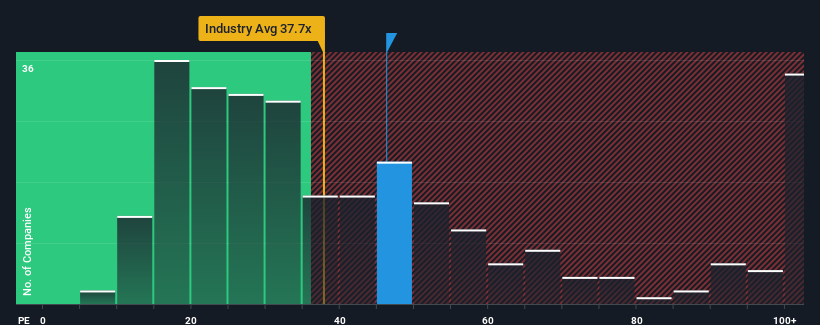

Even after such a large drop in price, Anhui Tongfeng Electronics may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 46.3x, since almost half of all companies in China have P/E ratios under 30x and even P/E's lower than 18x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Anhui Tongfeng Electronics has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Anhui Tongfeng Electronics

Check out our latest analysis for Anhui Tongfeng Electronics

Is There Enough Growth For Anhui Tongfeng Electronics?

In order to justify its P/E ratio, Anhui Tongfeng Electronics would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Likewise, not much has changed from three years ago as earnings have been stuck during that whole time. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Turning to the outlook, the next year should generate growth of 96% as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 42% growth forecast for the broader market.

In light of this, it's understandable that Anhui Tongfeng Electronics' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Anhui Tongfeng Electronics' P/E

Even after such a strong price drop, Anhui Tongfeng Electronics' P/E still exceeds the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Anhui Tongfeng Electronics' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Anhui Tongfeng Electronics that you should be aware of.

If you're unsure about the strength of Anhui Tongfeng Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.