Leaguer (Shenzhen) Microelectronics Corp. (SHSE:688589) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 21% in that time.

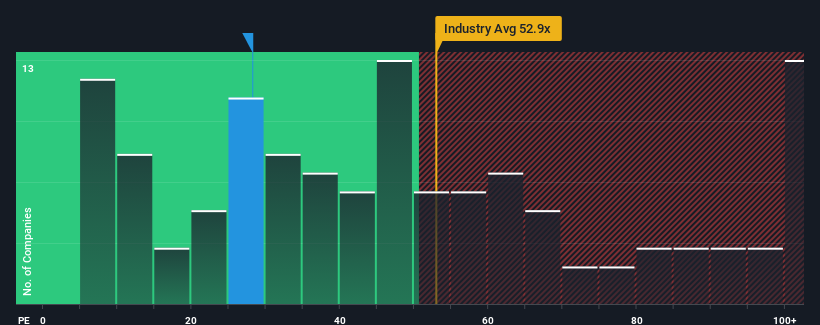

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Leaguer (Shenzhen) Microelectronics' P/E ratio of 28.2x, since the median price-to-earnings (or "P/E") ratio in China is also close to 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Leaguer (Shenzhen) Microelectronics certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Leaguer (Shenzhen) Microelectronics

View our latest analysis for Leaguer (Shenzhen) Microelectronics

Does Growth Match The P/E?

In order to justify its P/E ratio, Leaguer (Shenzhen) Microelectronics would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 37% last year. Pleasingly, EPS has also lifted 110% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 57% as estimated by the one analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 42%, which is noticeably less attractive.

In light of this, it's curious that Leaguer (Shenzhen) Microelectronics' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Leaguer (Shenzhen) Microelectronics' P/E?

With its share price falling into a hole, the P/E for Leaguer (Shenzhen) Microelectronics looks quite average now. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Leaguer (Shenzhen) Microelectronics currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Leaguer (Shenzhen) Microelectronics, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Leaguer (Shenzhen) Microelectronics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.