风格演绎极致

近期,市场业绩主线演绎明显,多只个股2023年业绩暴雷,今日股价出现大幅杀跌。

片仔癀盘中跌停

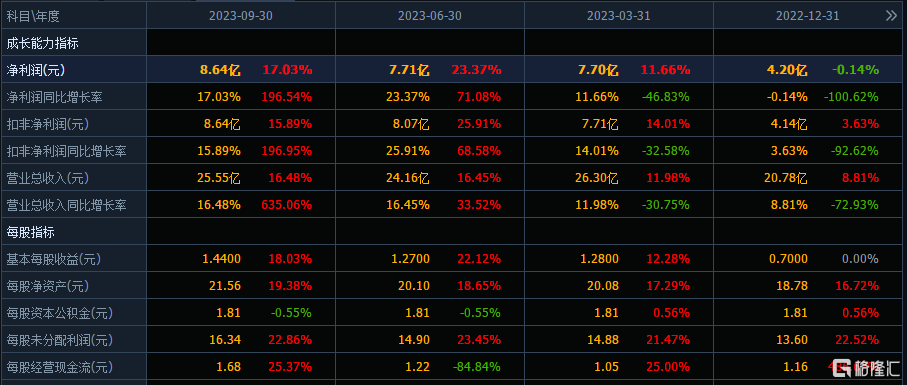

其中,“中药茅”片仔癀大幅低开,盘中一度跌停,后稍有所回升,截至午间收盘又跌停,报197.56元/股,总市值1192亿元。

片仔癀2023年业绩快报显示,公司2023年全年营业总收入100.35亿元,首次突破百亿元,同比增长15.42%;归母净利润27.84亿元,同比增长12.59%;基本每股收益4.61元。

第四季度,片仔癀净利润为3.75亿元,同比下降10.7%,而去年前三个季度,片仔癀的净利润同比来看均为增长,仅在四季度出现下滑。

多股遭遇业绩杀

近期,多家上市公司公布2023年业绩报告/预告,而公司股价也受此影响。

业绩好的诸如宁德时代在昨日创下新低140.4元/股后,今日股价大涨6%。

昨日盘后,宁德时代公告,预计2023年净利425亿元-455亿元,同比增38%-48%,净利首超400亿。

对此,花旗点评称,宁德时代去年初步业绩超过部分投资者预期,产量或3月开始增长。

业绩表现差的诸如青岛中程20CM跌停,合力泰、景峰医药文投控股、美吉姆、海正药业、博敏电子等多股一字跌停。

上述个股净利润去年均出现巨额亏损,且亏损额度相比上一年扩大明显,可能面临退市风险。

2023年,青岛中程预亏7.7亿-10.78亿元,上年同期亏损约1.53亿元,股票可能被实施退市风险警示;

年度“爆雷王”合力泰预亏90亿元至120亿元,上年同期亏损34.66亿元,亏损规模进一步加大,股票可能被实施退市风险警示;

美吉姆预亏6.7亿-9.3亿元,上年同期亏损4.4亿元,2023 年年末净资产可能为负值,股票可能被实施退市风险警示;

博敏电子预亏4.5亿-7.4亿元,上年同期净利润为7858.46万元,业绩变动主要原因是商誉减值计提,公司年四季度共计提各项减值准备4.24亿元-7.14亿元。

至于亏损的原因,相关公司都提到了行业变化因素,特别是地产、钢铁、电子、养殖等行业。此外,商誉减值也是部分公司爆雷的主因。

另一方面,除了基本面上的弱势,近期市场偏弱势,尽管政策层面出手护盘央企,但白马股的股价表现并不容乐观。

此背景下,一些负面信息很容易被市场情绪放大,从而导致股价大幅杀跌,比如之前的药明康德。

市场弱势叠加基本面上的担忧,就导致业绩主线在市场的演绎更为极致,表现好的公司还能抗一抗,表现差的公司遭遇大幅抛售。