Hubei Jiuzhiyang Infrared System Co., Ltd (SZSE:300516) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 14% in that time.

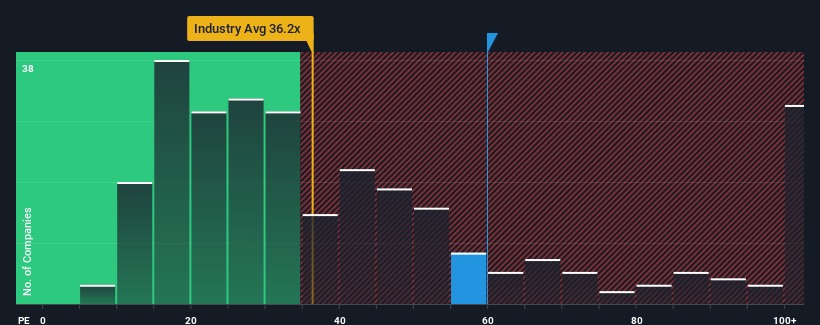

Although its price has dipped substantially, Hubei Jiuzhiyang Infrared System may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 59.8x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For instance, Hubei Jiuzhiyang Infrared System's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Hubei Jiuzhiyang Infrared System

Check out our latest analysis for Hubei Jiuzhiyang Infrared System

How Is Hubei Jiuzhiyang Infrared System's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Hubei Jiuzhiyang Infrared System's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's bottom line. Even so, admirably EPS has lifted 31% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 42% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Hubei Jiuzhiyang Infrared System's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Hubei Jiuzhiyang Infrared System's P/E?

Even after such a strong price drop, Hubei Jiuzhiyang Infrared System's P/E still exceeds the rest of the market significantly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Hubei Jiuzhiyang Infrared System currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Hubei Jiuzhiyang Infrared System with six simple checks.

If these risks are making you reconsider your opinion on Hubei Jiuzhiyang Infrared System, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.