The Inventronics (Hangzhou), Inc. (SZSE:300582) share price has fared very poorly over the last month, falling by a substantial 29%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 41% share price drop.

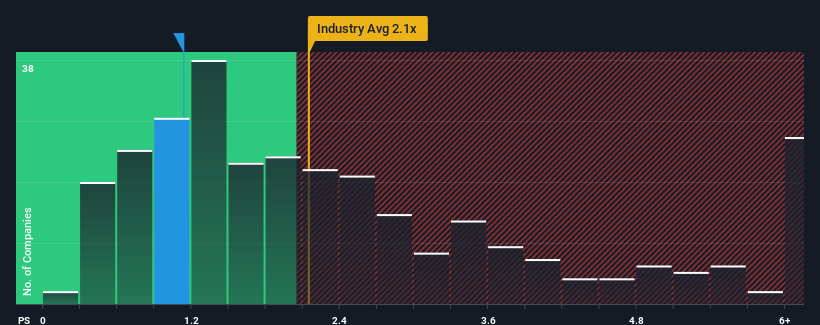

Since its price has dipped substantially, considering around half the companies operating in China's Electrical industry have price-to-sales ratios (or "P/S") above 2.1x, you may consider Inventronics (Hangzhou) as an solid investment opportunity with its 1.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Inventronics (Hangzhou)

What Does Inventronics (Hangzhou)'s P/S Mean For Shareholders?

Inventronics (Hangzhou) certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. Those who are bullish on Inventronics (Hangzhou) will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Inventronics (Hangzhou) certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. Those who are bullish on Inventronics (Hangzhou) will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Do Revenue Forecasts Match The Low P/S Ratio?

Inventronics (Hangzhou)'s P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 47%. The latest three year period has also seen an excellent 124% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 29% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we find it odd that Inventronics (Hangzhou) is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Key Takeaway

Inventronics (Hangzhou)'s recently weak share price has pulled its P/S back below other Electrical companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Inventronics (Hangzhou) currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. medium-term

Before you settle on your opinion, we've discovered 2 warning signs for Inventronics (Hangzhou) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.