Changzhou Aohong Electronics Co., Ltd. (SHSE:605058) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 23% in that time.

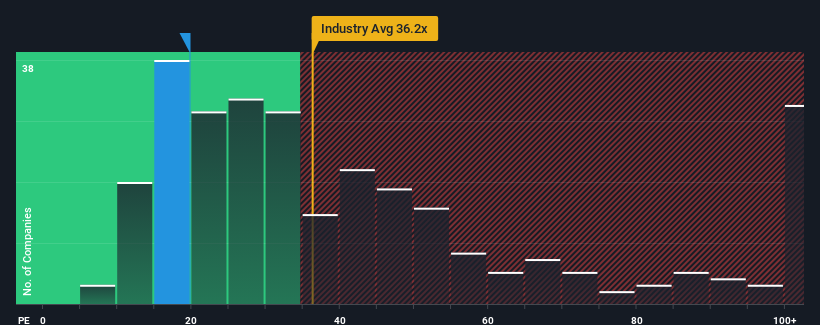

After such a large drop in price, Changzhou Aohong Electronics may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 19.7x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 54x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

For instance, Changzhou Aohong Electronics' receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Changzhou Aohong Electronics

Check out our latest analysis for Changzhou Aohong Electronics

How Is Changzhou Aohong Electronics' Growth Trending?

Changzhou Aohong Electronics' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 22%. This means it has also seen a slide in earnings over the longer-term as EPS is down 26% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 42% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that Changzhou Aohong Electronics' P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Changzhou Aohong Electronics' P/E has taken a tumble along with its share price. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Changzhou Aohong Electronics revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Changzhou Aohong Electronics that you should be aware of.

If you're unsure about the strength of Changzhou Aohong Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.