The Weihai Huadong Automation Co., Ltd (SZSE:002248) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 42% in that time.

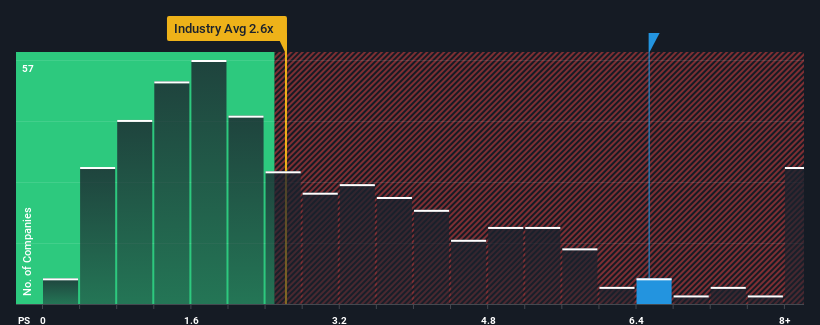

Even after such a large drop in price, you could still be forgiven for thinking Weihai Huadong Automation is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.5x, considering almost half the companies in China's Machinery industry have P/S ratios below 2.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Weihai Huadong Automation

What Does Weihai Huadong Automation's Recent Performance Look Like?

We'd have to say that with no tangible growth over the last year, Weihai Huadong Automation's revenue has been unimpressive. Perhaps the market believes that revenue growth will improve markedly over current levels, inflating the P/S ratio. If not, then existing shareholders may be a little nervous about the viability of the share price.

We'd have to say that with no tangible growth over the last year, Weihai Huadong Automation's revenue has been unimpressive. Perhaps the market believes that revenue growth will improve markedly over current levels, inflating the P/S ratio. If not, then existing shareholders may be a little nervous about the viability of the share price.

How Is Weihai Huadong Automation's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Weihai Huadong Automation's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Although pleasingly revenue has lifted 37% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

This is in contrast to the rest of the industry, which is expected to grow by 28% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Weihai Huadong Automation's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Weihai Huadong Automation's P/S Mean For Investors?

A significant share price dive has done very little to deflate Weihai Huadong Automation's very lofty P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Weihai Huadong Automation currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You should always think about risks. Case in point, we've spotted 3 warning signs for Weihai Huadong Automation you should be aware of, and 1 of them is a bit concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.