Sichuan Xunyou Network Technology Co., Ltd. (SZSE:300467) shares have had a horrible month, losing 26% after a relatively good period beforehand. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

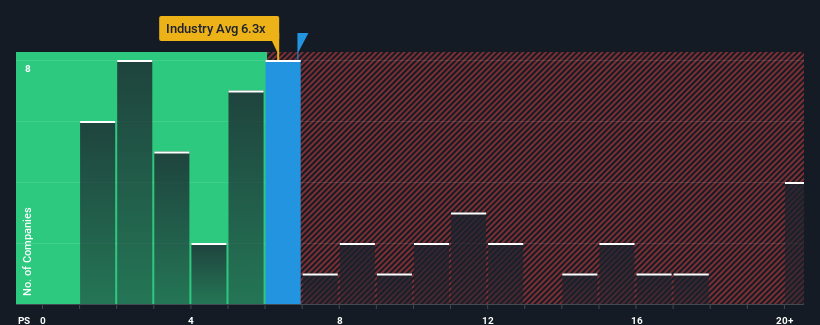

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Sichuan Xunyou Network Technology's P/S ratio of 6.9x, since the median price-to-sales (or "P/S") ratio for the Entertainment industry in China is also close to 6.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Sichuan Xunyou Network Technology

What Does Sichuan Xunyou Network Technology's P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for Sichuan Xunyou Network Technology, which is generally not a bad outcome. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Revenue has risen at a steady rate over the last year for Sichuan Xunyou Network Technology, which is generally not a bad outcome. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

How Is Sichuan Xunyou Network Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Sichuan Xunyou Network Technology would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.9%. However, this wasn't enough as the latest three year period has seen an unpleasant 18% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 36% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Sichuan Xunyou Network Technology's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

What Does Sichuan Xunyou Network Technology's P/S Mean For Investors?

Following Sichuan Xunyou Network Technology's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at Sichuan Xunyou Network Technology revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Sichuan Xunyou Network Technology, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.