For many, the main point of investing is to generate higher returns than the overall market. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Tong Ren Tang Technologies Co. Ltd. (HKG:1666) shareholders for doubting their decision to hold, with the stock down 49% over a half decade. More recently, the share price has dropped a further 14% in a month. However, we note the price may have been impacted by the broader market, which is down 5.6% in the same time period.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Tong Ren Tang Technologies

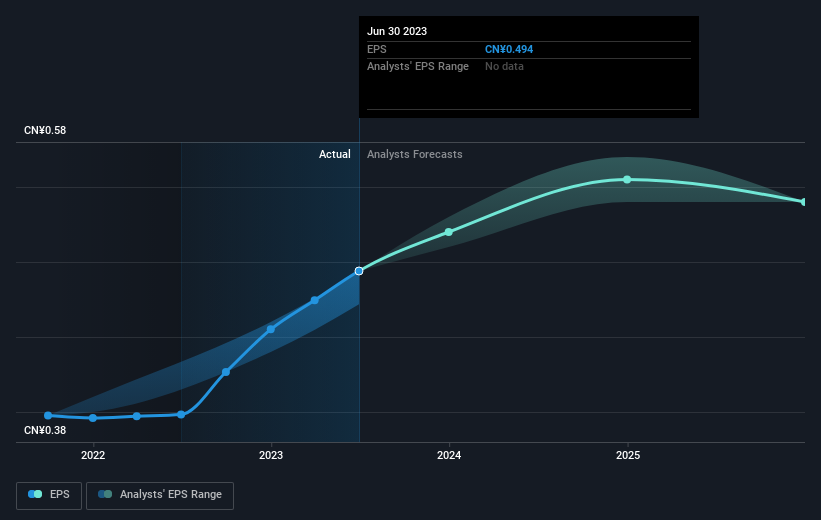

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years over which the share price declined, Tong Ren Tang Technologies' earnings per share (EPS) dropped by 1.5% each year. This reduction in EPS is less than the 13% annual reduction in the share price. This implies that the market is more cautious about the business these days. The less favorable sentiment is reflected in its current P/E ratio of 10.40.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Tong Ren Tang Technologies has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Tong Ren Tang Technologies will grow revenue in the future.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Tong Ren Tang Technologies' TSR for the last 5 years was -42%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While it's certainly disappointing to see that Tong Ren Tang Technologies shares lost 1.5% throughout the year, that wasn't as bad as the market loss of 18%. Of far more concern is the 7% p.a. loss served to shareholders over the last five years. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. Importantly, we haven't analysed Tong Ren Tang Technologies' dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.