The Foshan Golden Milky Way Intelligent Equipment Co., Ltd. (SZSE:300619) share price has fared very poorly over the last month, falling by a substantial 27%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 40% share price drop.

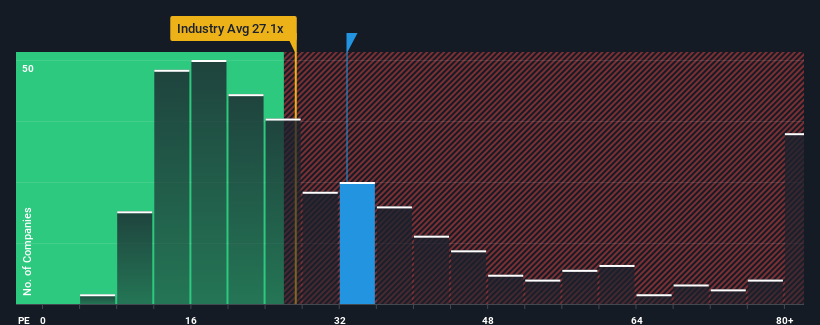

Even after such a large drop in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may still consider Foshan Golden Milky Way Intelligent Equipment as a stock to potentially avoid with its 32.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Foshan Golden Milky Way Intelligent Equipment certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Foshan Golden Milky Way Intelligent Equipment

View our latest analysis for Foshan Golden Milky Way Intelligent Equipment

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Foshan Golden Milky Way Intelligent Equipment's is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 113% last year. The latest three year period has also seen an excellent 1,452% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 42% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that Foshan Golden Milky Way Intelligent Equipment's P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

Despite the recent share price weakness, Foshan Golden Milky Way Intelligent Equipment's P/E remains higher than most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Foshan Golden Milky Way Intelligent Equipment maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 5 warning signs for Foshan Golden Milky Way Intelligent Equipment (4 don't sit too well with us!) that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.