Shenzhen Auto Electric Power Plant Co.,Ltd (SZSE:002227) shares have had a horrible month, losing 28% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 31% share price drop.

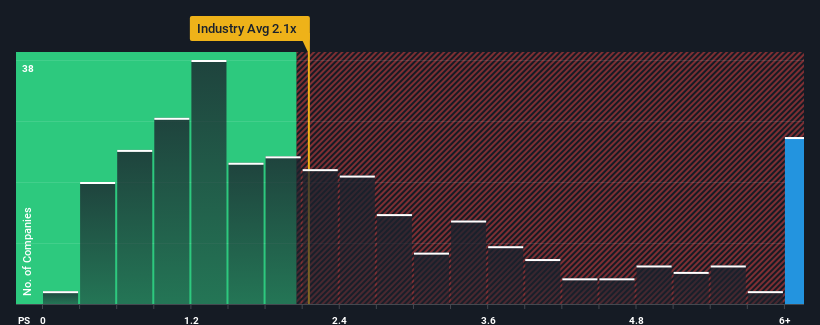

Even after such a large drop in price, when almost half of the companies in China's Electrical industry have price-to-sales ratios (or "P/S") below 2.1x, you may still consider Shenzhen Auto Electric Power PlantLtd as a stock not worth researching with its 7.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Shenzhen Auto Electric Power PlantLtd

How Shenzhen Auto Electric Power PlantLtd Has Been Performing

Shenzhen Auto Electric Power PlantLtd has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

Shenzhen Auto Electric Power PlantLtd has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Shenzhen Auto Electric Power PlantLtd's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 20% gain to the company's top line. The latest three year period has also seen a 8.5% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 29% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that Shenzhen Auto Electric Power PlantLtd's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Shenzhen Auto Electric Power PlantLtd's P/S?

Even after such a strong price drop, Shenzhen Auto Electric Power PlantLtd's P/S still exceeds the industry median significantly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Shenzhen Auto Electric Power PlantLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Plus, you should also learn about these 2 warning signs we've spotted with Shenzhen Auto Electric Power PlantLtd.

If these risks are making you reconsider your opinion on Shenzhen Auto Electric Power PlantLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.