The Mianyang Fulin Precision Co.,Ltd. (SZSE:300432) share price has fared very poorly over the last month, falling by a substantial 34%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 57% loss during that time.

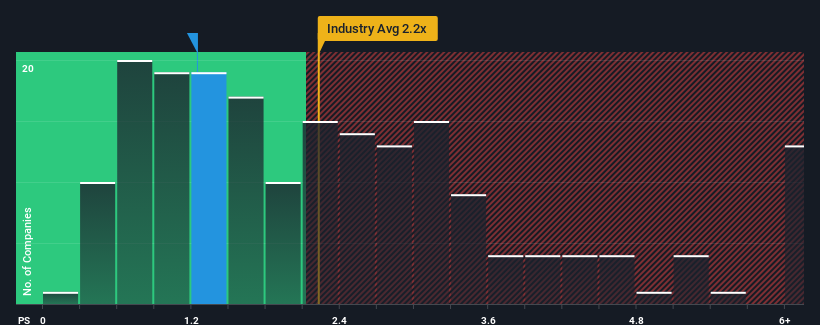

Since its price has dipped substantially, considering around half the companies operating in China's Auto Components industry have price-to-sales ratios (or "P/S") above 2.2x, you may consider Mianyang Fulin PrecisionLtd as an solid investment opportunity with its 1.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Mianyang Fulin PrecisionLtd

What Does Mianyang Fulin PrecisionLtd's Recent Performance Look Like?

Recent times have been advantageous for Mianyang Fulin PrecisionLtd as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Mianyang Fulin PrecisionLtd's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Mianyang Fulin PrecisionLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 8.4% during the coming year according to the lone analyst following the company. With the industry predicted to deliver 25% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Mianyang Fulin PrecisionLtd is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Mianyang Fulin PrecisionLtd's recently weak share price has pulled its P/S back below other Auto Components companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Mianyang Fulin PrecisionLtd maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

You always need to take note of risks, for example - Mianyang Fulin PrecisionLtd has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Mianyang Fulin PrecisionLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.