Vanjee Technology Co., Ltd. (SZSE:300552) shares have had a horrible month, losing 36% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 11% in that time.

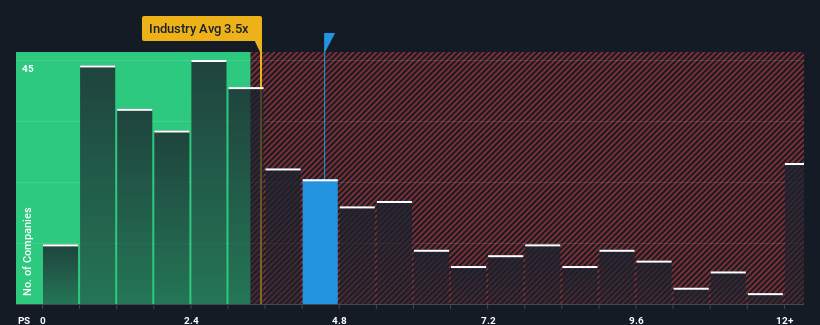

In spite of the heavy fall in price, you could still be forgiven for thinking Vanjee Technology is a stock not worth researching with a price-to-sales ratios (or "P/S") of 4.5x, considering almost half the companies in China's Electronic industry have P/S ratios below 3.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Vanjee Technology

What Does Vanjee Technology's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Vanjee Technology has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

With revenue growth that's superior to most other companies of late, Vanjee Technology has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Vanjee Technology's to be considered reasonable.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 74% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 27% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 60%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Vanjee Technology's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Vanjee Technology's P/S Mean For Investors?

Despite the recent share price weakness, Vanjee Technology's P/S remains higher than most other companies in the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Vanjee Technology trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware Vanjee Technology is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of Vanjee Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.