Gan & Lee Pharmaceuticals. (SHSE:603087) shares have had a horrible month, losing 30% after a relatively good period beforehand. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

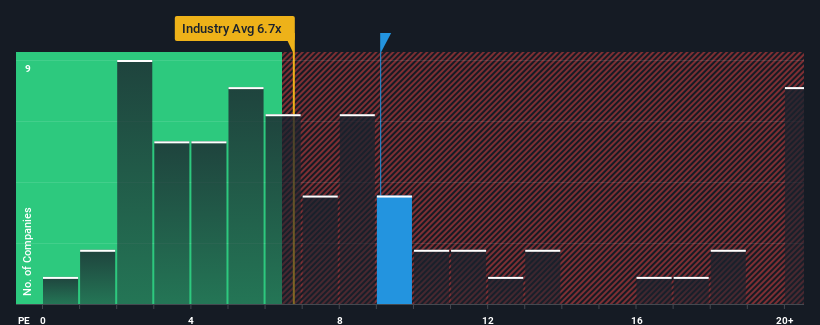

Although its price has dipped substantially, given close to half the companies operating in China's Biotechs industry have price-to-sales ratios (or "P/S") below 6.7x, you may still consider Gan & Lee Pharmaceuticals as a stock to potentially avoid with its 9.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Gan & Lee Pharmaceuticals

What Does Gan & Lee Pharmaceuticals' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Gan & Lee Pharmaceuticals has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

With revenue growth that's inferior to most other companies of late, Gan & Lee Pharmaceuticals has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Gan & Lee Pharmaceuticals would need to produce impressive growth in excess of the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 26% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 31% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 825%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Gan & Lee Pharmaceuticals' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Gan & Lee Pharmaceuticals' P/S?

There's still some elevation in Gan & Lee Pharmaceuticals' P/S, even if the same can't be said for its share price recently. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Gan & Lee Pharmaceuticals, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

Plus, you should also learn about these 3 warning signs we've spotted with Gan & Lee Pharmaceuticals (including 2 which are significant).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.