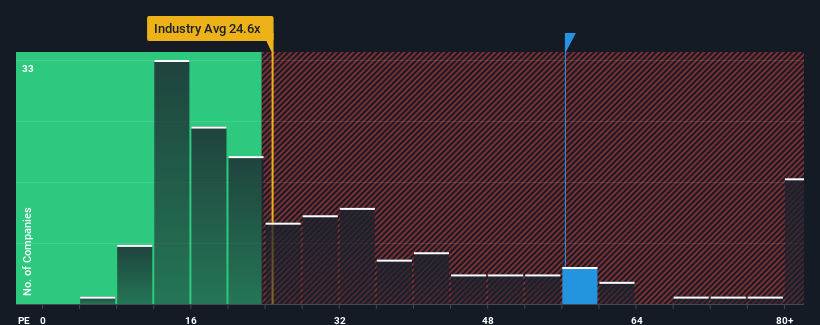

When close to half the companies in China have price-to-earnings ratios (or "P/E's") below 27x, you may consider Guizhou Bailing Group Pharmaceutical Co., Ltd. (SZSE:002424) as a stock to avoid entirely with its 56.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Guizhou Bailing Group Pharmaceutical certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors' willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Guizhou Bailing Group Pharmaceutical

Is There Enough Growth For Guizhou Bailing Group Pharmaceutical?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Guizhou Bailing Group Pharmaceutical's to be considered reasonable.

There's an inherent assumption that a company should far outperform the market for P/E ratios like Guizhou Bailing Group Pharmaceutical's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 107% gain to the company's bottom line. As a result, it also grew EPS by 22% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 131% over the next year. With the market only predicted to deliver 42%, the company is positioned for a stronger earnings result.

With this information, we can see why Guizhou Bailing Group Pharmaceutical is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Guizhou Bailing Group Pharmaceutical's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Guizhou Bailing Group Pharmaceutical maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Guizhou Bailing Group Pharmaceutical with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.