Zhejiang Zone-King Environmental Sci&Tech Co., Ltd. (SHSE:688701) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 20% in that time.

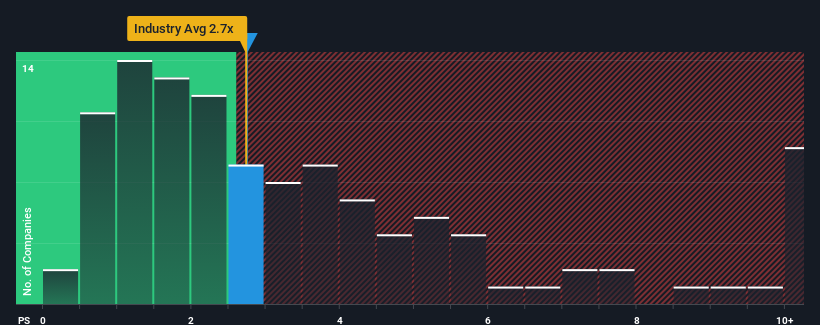

Although its price has dipped substantially, there still wouldn't be many who think Zhejiang Zone-King Environmental Sci&Tech's price-to-sales (or "P/S") ratio of 2.7x is worth a mention when it essentially matches the median P/S in China's Commercial Services industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Has Zhejiang Zone-King Environmental Sci&Tech Performed Recently?

We'd have to say that with no tangible growth over the last year, Zhejiang Zone-King Environmental Sci&Tech's revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

Although there are no analyst estimates available for Zhejiang Zone-King Environmental Sci&Tech, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Zhejiang Zone-King Environmental Sci&Tech?

The only time you'd be comfortable seeing a P/S like Zhejiang Zone-King Environmental Sci&Tech's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Zhejiang Zone-King Environmental Sci&Tech's is when the company's growth is tracking the industry closely.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. That's essentially a continuation of what we've seen over the last three years, as its revenue growth has been virtually non-existent for that entire period. Therefore, it's fair to say that revenue growth has definitely eluded the company recently.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 30% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Zhejiang Zone-King Environmental Sci&Tech's P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Zhejiang Zone-King Environmental Sci&Tech looks to be in line with the rest of the Commercial Services industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Zhejiang Zone-King Environmental Sci&Tech currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Zhejiang Zone-King Environmental Sci&Tech you should know about.

If these risks are making you reconsider your opinion on Zhejiang Zone-King Environmental Sci&Tech, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.