The Kennede Electronics MFG. Co., Ltd. (SZSE:002723) share price has fared very poorly over the last month, falling by a substantial 29%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 36% share price drop.

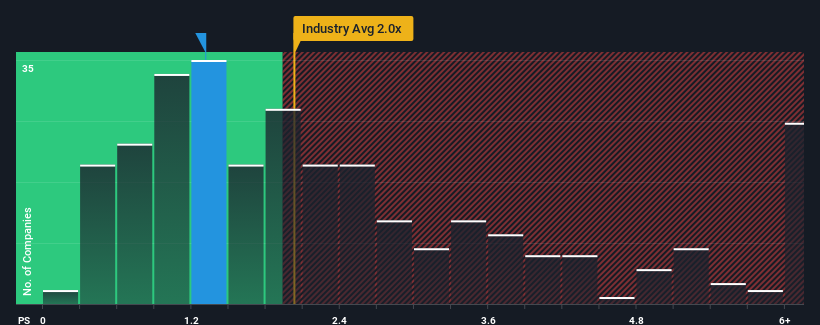

Even after such a large drop in price, when close to half the companies operating in China's Electrical industry have price-to-sales ratios (or "P/S") above 2x, you may still consider Kennede Electronics MFG as an enticing stock to check out with its 1.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has Kennede Electronics MFG Performed Recently?

Kennede Electronics MFG's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Kennede Electronics MFG's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Kennede Electronics MFG's is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Kennede Electronics MFG's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. The latest three year period has also seen an excellent 68% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 21% during the coming year according to the only analyst following the company. That's shaping up to be materially lower than the 28% growth forecast for the broader industry.

With this information, we can see why Kennede Electronics MFG is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Kennede Electronics MFG's P/S

Kennede Electronics MFG's recently weak share price has pulled its P/S back below other Electrical companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Kennede Electronics MFG's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Kennede Electronics MFG that we have uncovered.

If these risks are making you reconsider your opinion on Kennede Electronics MFG, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.