Modern Living Investments Holdings Limited (HKG:8426) shares have continued their recent momentum with a 91% gain in the last month alone. The annual gain comes to 111% following the latest surge, making investors sit up and take notice.

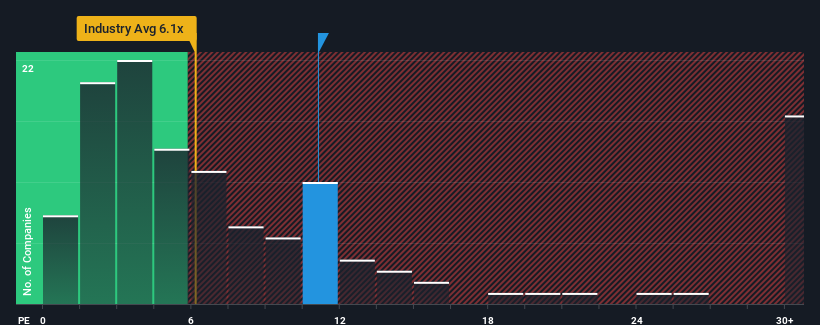

Since its price has surged higher, given around half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 8x, you may consider Modern Living Investments Holdings as a stock to potentially avoid with its 11.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

For instance, Modern Living Investments Holdings' receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Modern Living Investments Holdings' to be considered reasonable.

There's an inherent assumption that a company should outperform the market for P/E ratios like Modern Living Investments Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 31% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's noticeably less attractive on an annualised basis.

With this information, we find it concerning that Modern Living Investments Holdings is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Modern Living Investments Holdings' P/E?

Modern Living Investments Holdings' P/E is getting right up there since its shares have risen strongly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Modern Living Investments Holdings currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 3 warning signs for Modern Living Investments Holdings you should be aware of.

If you're unsure about the strength of Modern Living Investments Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.