Harbin Dongan Auto Engine Co.,Ltd (SHSE:600178) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 59%, which is great even in a bull market.

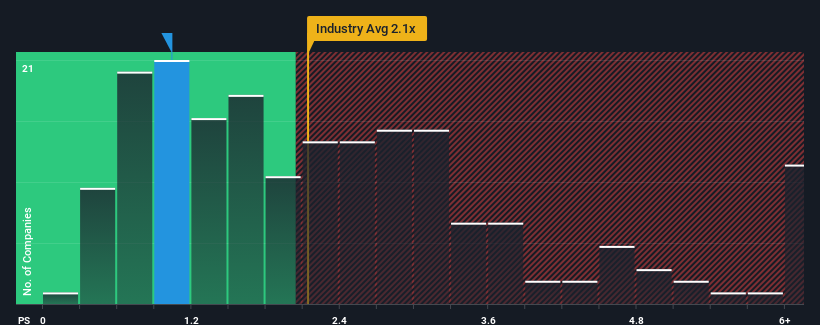

Even after such a large drop in price, when close to half the companies operating in China's Auto Components industry have price-to-sales ratios (or "P/S") above 2.1x, you may still consider Harbin Dongan Auto EngineLtd as an enticing stock to check out with its 1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Harbin Dongan Auto EngineLtd Has Been Performing

As an illustration, revenue has deteriorated at Harbin Dongan Auto EngineLtd over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Harbin Dongan Auto EngineLtd will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Harbin Dongan Auto EngineLtd's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Harbin Dongan Auto EngineLtd?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Harbin Dongan Auto EngineLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 14% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 25% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why Harbin Dongan Auto EngineLtd's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Key Takeaway

Harbin Dongan Auto EngineLtd's recently weak share price has pulled its P/S back below other Auto Components companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Harbin Dongan Auto EngineLtd revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Harbin Dongan Auto EngineLtd (1 doesn't sit too well with us!) that we have uncovered.

If these risks are making you reconsider your opinion on Harbin Dongan Auto EngineLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.