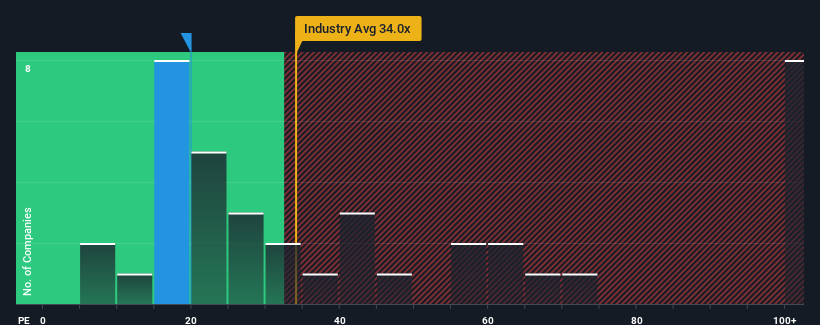

With a price-to-earnings (or "P/E") ratio of 19.9x Shenzhen Capol International & Associatesco.,Ltd (SZSE:002949) may be sending bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 28x and even P/E's higher than 51x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

The recently shrinking earnings for Shenzhen Capol International & Associatesco.Ltd have been in line with the market. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. You'd much rather the company wasn't bleeding earnings if you still believe in the business. At the very least, you'd be hoping that earnings don't fall off a cliff if your plan is to pick up some stock while it's out of favour.

How Is Shenzhen Capol International & Associatesco.Ltd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Shenzhen Capol International & Associatesco.Ltd's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.5%. This means it has also seen a slide in earnings over the longer-term as EPS is down 32% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.5%. This means it has also seen a slide in earnings over the longer-term as EPS is down 32% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 99% as estimated by the six analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 42%, which is noticeably less attractive.

With this information, we find it odd that Shenzhen Capol International & Associatesco.Ltd is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shenzhen Capol International & Associatesco.Ltd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Shenzhen Capol International & Associatesco.Ltd you should be aware of.

Of course, you might also be able to find a better stock than Shenzhen Capol International & Associatesco.Ltd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.