It's easy to feel disappointed if you buy a stock that goes down. But sometimes broader market conditions have more of an impact on prices than the actual business performance. The Chengdu huasun technology group Inc. , LTD. (SZSE:000790) is down 19% over a year, but the total shareholder return is -18% once you include the dividend. That's better than the market which declined 25% over the last year. However, the longer term returns haven't been so bad, with the stock down 2.0% in the last three years. In the last ninety days we've seen the share price slide 27%. But this could be related to the weak market, which is down 15% in the same period.

Since Chengdu huasun technology group has shed CN¥414m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

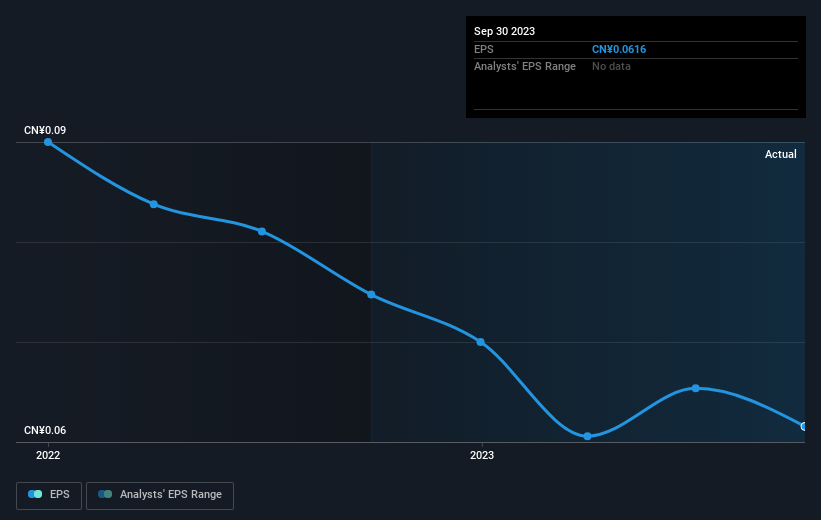

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Unfortunately Chengdu huasun technology group reported an EPS drop of 18% for the last year. Remarkably, he share price decline of 19% per year is particularly close to the EPS drop. Therefore one could posit that the market has not become more concerned about the company, despite the lower EPS. Instead, the change in the share price seems to reduction in earnings per share, alone.

Unfortunately Chengdu huasun technology group reported an EPS drop of 18% for the last year. Remarkably, he share price decline of 19% per year is particularly close to the EPS drop. Therefore one could posit that the market has not become more concerned about the company, despite the lower EPS. Instead, the change in the share price seems to reduction in earnings per share, alone.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Chengdu huasun technology group's earnings, revenue and cash flow.

A Different Perspective

While it's certainly disappointing to see that Chengdu huasun technology group shares lost 18% throughout the year, that wasn't as bad as the market loss of 25%. Longer term investors wouldn't be so upset, since they would have made 1.4%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Chengdu huasun technology group is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.